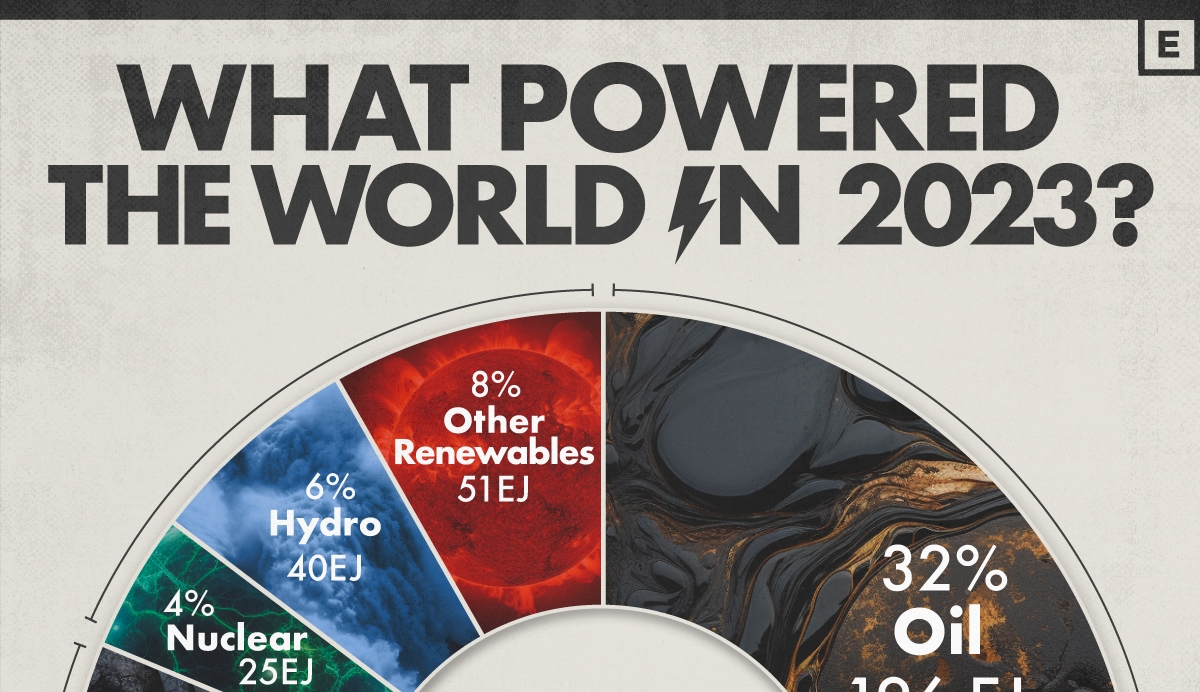

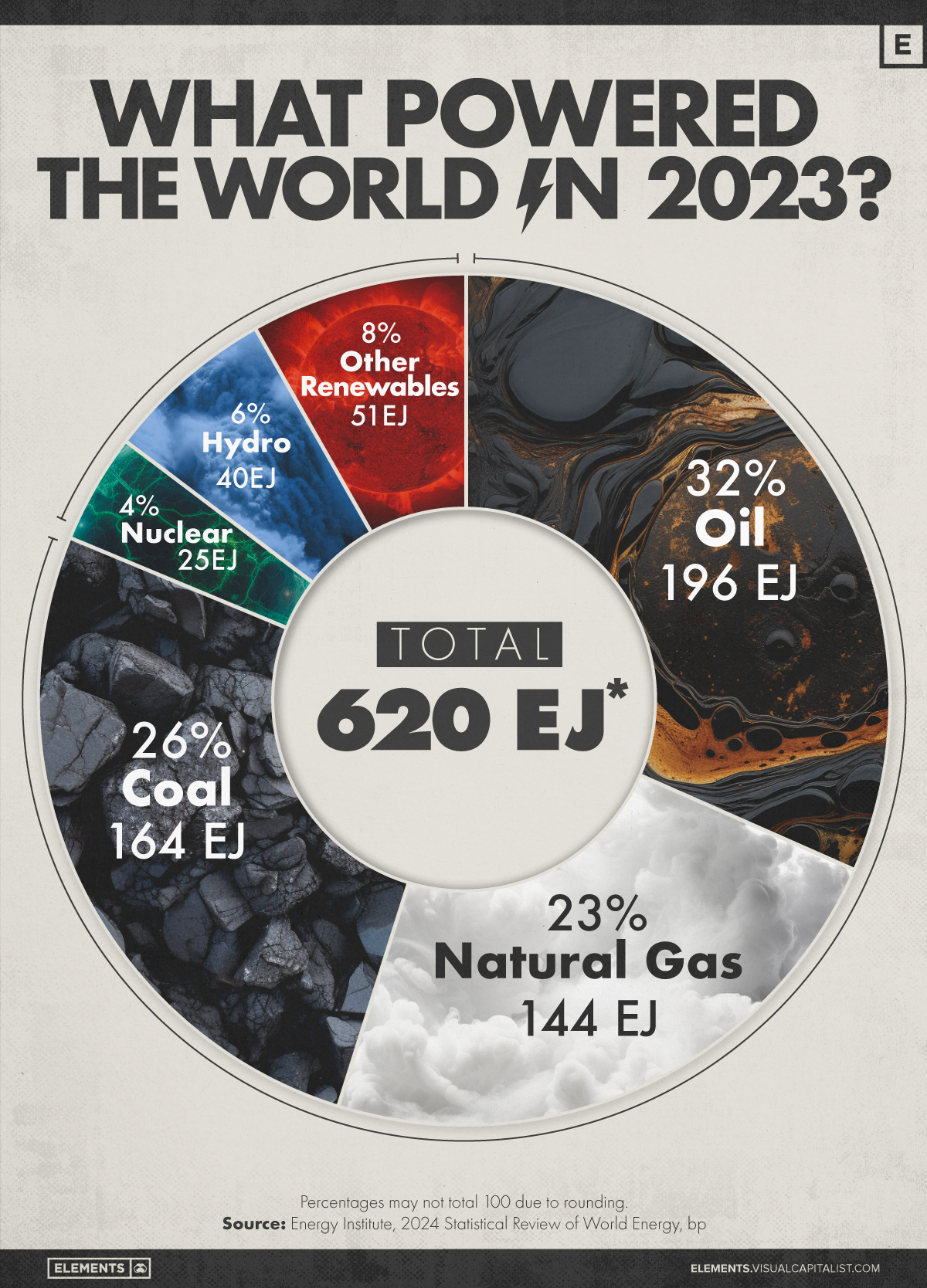

A picture paints a thousand words & here’s a very sobering picture:

So last year, 81% of the world’s power came from fossil fuels.

This is down slightly in 2024 so far due to Europe using more renewables, but China and India are still building coal plants for energy & industry.

Yes… building, that means that they don’t expect to use less coal any time soon… yikes!

Which brings us to the topic of this conversation…. Gas & the Prospects for Woodside Energy

The energy mix is shifting as part of the global transition to net zero, and this includes a changing role for natural gas.

Where are we? Mixed messages on gas

The current state of play in the natural gas market involves a mix of different sentiments & outlooks.

On the one hand, investment in the oil and gas sector remains strong, and we have seen a number of high-value transactions in the sector over the past five years, both in Australia and internationally.

On the other hand, gas producers are facing increased scrutiny over their environmental impacts, are experiencing significant environmental activism, and are finding it increasingly difficult to get finance. A number of large Australian and international banks are restricting lending to gas producers.

There has also been an unprecedented level of government intervention in the gas sector in Australia recently, with the Federal Government’s Gas Code of Conduct and associated price caps now law and significant reforms having been made to the Australian Domestic Gas Security Mechanism.

Finally, it is important to note that the path away from gas in Australia can be differentiated from, yet is also influenced by, broader global dynamics, particularly gas use in Asia.

Demand for gas in Asia remains strong.

As a significant supplier of LNG to Asia, Australia will likely continue to produce gas for export even when domestic gas use declines.

The Future Gas Strategy Paper recognises the importance of maintaining Australia’s reputation as a trusted trade and investment partner, even while domestic decarbonisation occurs.

Both the International Energy Agency (IEA) & the Federal Government have recognised the role that natural gas can play in the energy transition—that being to support a shift to renewable energy infrastructure.

Let’s have a brief look at Australia’s Future Gas Strategy Paper

Our trading partners in the Asia-Pacific region need our gas for industrial inputs and energy to warm and cool homes, cook meals, and help them achieve their reduction goals (although somewhat more modest than net zero).

We need to use less coal, even if it means using more gas, as we are not prepared to wean ourselves off reliable energy. In fact, the opposite is true: As a population, we demand the reliability of the grid.

That’s why Australia developed a future gas strategy to help governments, industry, and the community plan for the coming decades and balance competing demands.

The strategy lays down several core principles.

Australia is committed to reaching net zero emissions by 2050, & we will need gas to get there.

And gas must remain affordable for Australian customers.

The future gas strategy includes a detailed analysis of the future demand for gas. The findings are clear & based on facts & data, not ideology or wishful thinking.

Gas is needed out to 2050 & beyond, but its role is changing.

The energy transformation will take time and require investment in renewables, new industry processes, and new technologies.

Turning off gas overnight would do enormous damage to our economy, impede efforts to get to net zero, & have a severe impact on our region, which is the fastest growing in the world.

Yes, we hear you, continued use is damaging BUT no other viable alternative is available right now.

Pretending otherwise is counterproductive & won’t help Australia & our region get to net zero.

A future made in Australia needs affordable, reliable & clean energy.

Australian gas is part of the future.

Gas-powered electricity firms up renewable power generation, helping Australia achieve its target of 82% renewables by 2030.

Our manufacturing sector needs gas for a range of industries, such as producing food, processing critical minerals, and manufacturing fertiliser, cement, glass, and bricks.

Australia’s gas industry is one of our country’s great economic success stories.

Since the 1980s, the industry has grown to supply around 20% of the world’s gas, earning about $72 billion of export income for Australia’s economy in 2023-24. The industry creates highly paid and skilled jobs. It pays for roads, hospitals, schools, and our security.

According to Allens, the industry supports more than 80,000 jobs, mostly in regional & remote areas, & provides energy to more than five million households.

Emissions from gas are being managed & reduced, primarily through Australia’s safeguard mechanism & fuel-switching.

But there is more to do & the gas industry will do more.

Realising Australia’s geological storage potential is an integral part of the future gas strategy.

The strategy also clarifies that we can’t rely on past investments to get us through the following decades as existing fields deplete.

Australia will need continued investment to develop gas supplies to get us through the energy transition with thriving industries.

That will mean a continued commitment to exploration.

Finally, the future gas strategy reaffirms that Australia is and will remain a reliable and trusted trade and investment partner.

Transition from coal

Coal is generally recognised as the “dirtiest” energy offender, followed by oil.

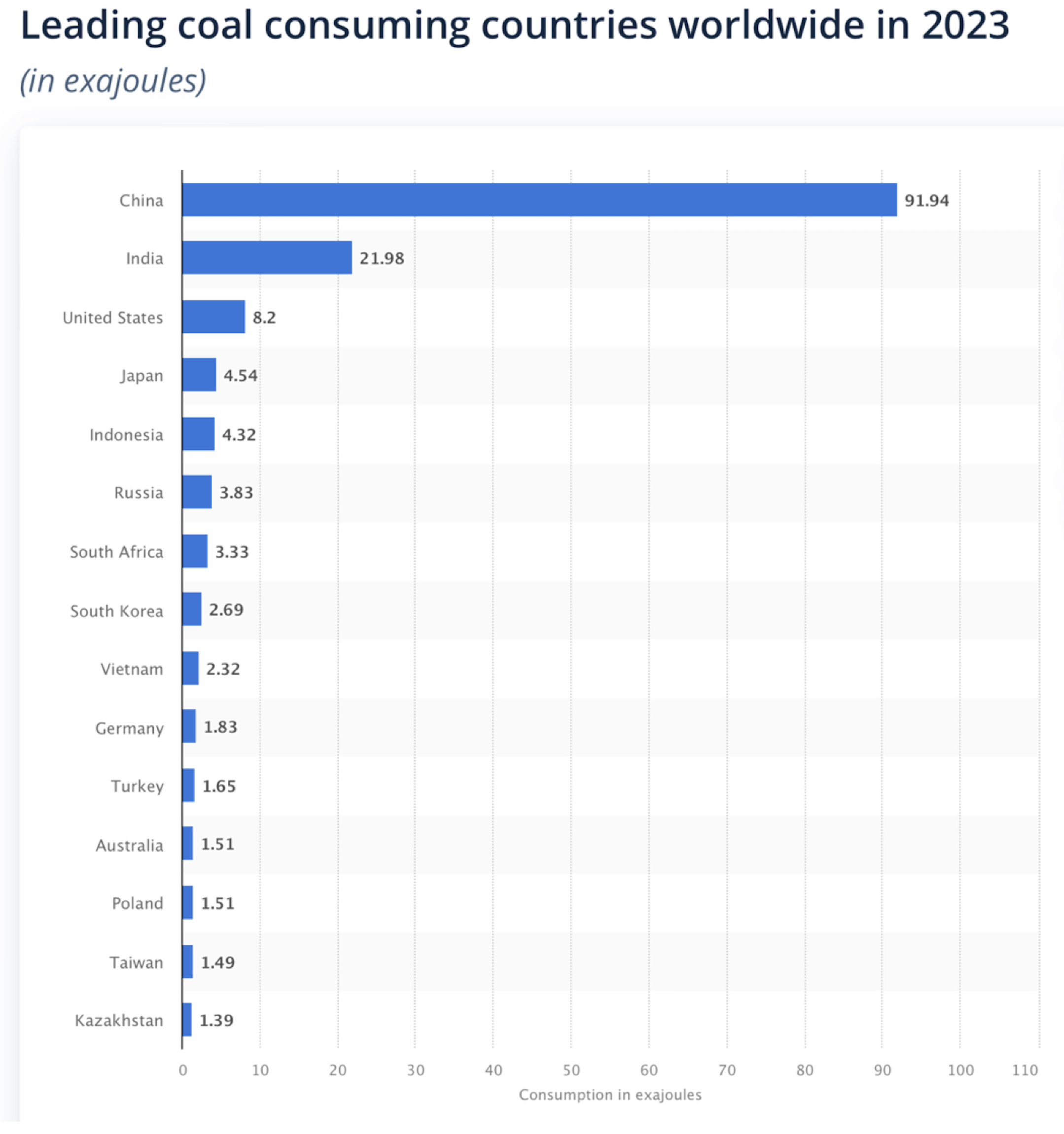

Here is an interactive chart of Coal Consumption by Country in 2024. On the right is the static version in 2023.

China (92 exajoules), India (22 exajoules), and then the USA (8 exajoules) are the largest consumers of coal.

So, China & India, the two sources of global economic growth, still heavily rely on coal.

Don’t get us wrong—they are making good progress in using renewables, but they still need energy to power their growing economies.

So, natural gas will remain part of the longer-term global energy solution.

Over the short to medium term in Australia, substituting current coal-power station capacity with natural gas power station capacity may ensure that:

Source: Statista.com

- Higher sources of emissions (i.e. coal-power stations) are replaced with lower sources of emissions (i.e. natural gas power stations) in an orderly fashion; &

- There is reliable capacity in Australia’s electricity grids (i.e., a power source that can be easily deployed to maintain the electricity supply and sustain the electricity grid over a particular period), which can be deployed to stabilise intermittent renewable energy production (e.g. when the sun is not shining or the wind is not blowing).

No simple solutions

It is critical that the global transition to net zero is cost-effective and facilitates reliable energy supply.

Achieving this may mean having to choose between unattractive options.

Advocates of longer-term use of natural gas point to the possibility that it will enable a smooth and cost-effective transition to renewables by allowing coal to be phased out and providing firming capacity to support renewable energy production while other technologies, such as hydrogen, are developed.

A counterargument is that prolonged gas use will simply delay the inevitable transition and result in a more chaotic energy environment in the future.

While India and China have ambitious plans to cut emissions, heavy reliance on coal continues to be the most reliable and affordable way to meet rising energy demand.

There is a great deal of optimism about India’s rising economy and its potential to replace China as the engine of global growth.

According to Bloomberg Economics’ analysis, India could become the world’s top contributor to GDP growth as early as 2028.

To get there, Prime Minister Narendra Modi will need to hit ambitious goals in four crucial development areas:

- Building better infrastructure

- Expanding the skills and participation of the workforce

- Building better cities to house all those workers

- Luring more factories to provide them with jobs

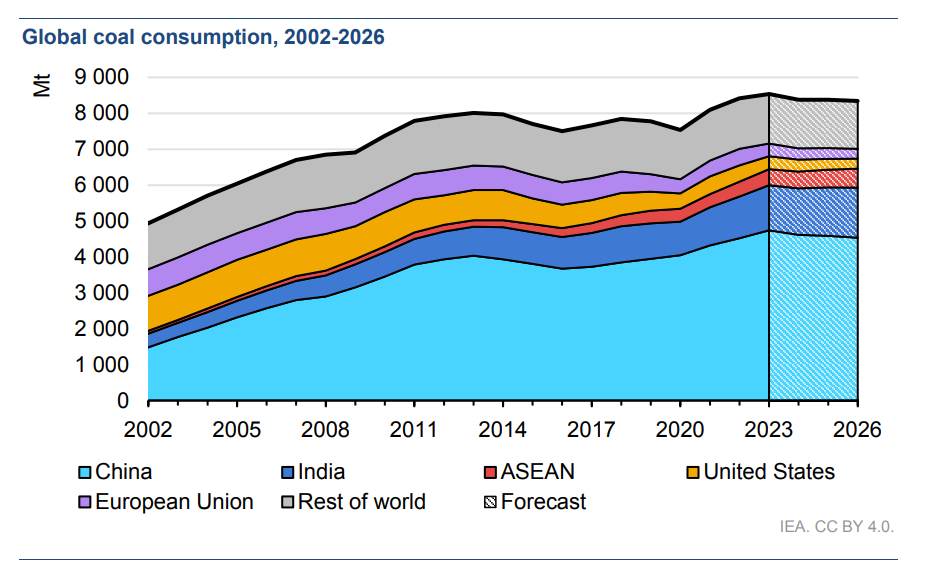

The following chart shows that while the global community is expected to use less coal over the next few years, we are still using it.

Source: iea

What does this mean for Woodside?

Using less coal is what we want.

To do that, we will need to switch to gas first, then switch to renewables when we can rely on the supply of power.

We are a long way from that.

Woodside is Australia’s premier gas producer. Gas accounts for 80% of revenue & gearing is still conservative at just 13%.

Woodside traded at $38 late in 2024. Since then, it has declined to current levels of ~$26 – a 30% drop in share price.

At $26, Morningstar forecasts 2025 dividend yield at 6.8%, fully franked = 9.7% grossed up (i.e., what you actually receive before you pay tax).

We can’t see a reason not to buy it, and there are many compelling reasons to take advantage of the share price weakness and buy the dip.

So, we expect Woodside to provide medium-term capital growth with sound dividend income.

Source: Market Index

Further reading: What are we prepared to pay for safe & clean energy?