The Government has proposed several changes to the support available for ageing Australians at home and in residential aged care services. The changes will apply from 1 July 2025.

With the number of Australians over 80 projected to triple in the next 40 years, the sustainability of the aged care industry is at risk. In the 2022/23 period, 46% of aged care providers reported losses from accommodation services.

In response to these challenges, the Aged Care Taskforce, a group of experts in the field, was established in 2023. Their mission was to thoroughly investigate the issues and propose recommendations for enhancing the sector’s sustainability. Their findings outlined several suggestions for the government.

Ultimately, your income and/or assets will determine how much you have to pay. If they exceed certain levels, you may need to pay more towards your care costs if you enter the system after 1 July 2025. The specific increase in your contribution will depend on your circumstances.

The government has stated that it is anticipated that half of all new residents entering residential care from 1 July 2025 will not incur higher costs under the new system. Specifically:

- No ‘fully supported’* resident will pay more.

- Seven out of ten individuals receiving the full Age Pension will not pay more.

- One in four part Age Pensioners will not pay more.

*A fully supported resident is someone whose income and assets fall below established thresholds and who is eligible for the government to cover their accommodation fee and most ongoing care fees.

Fees

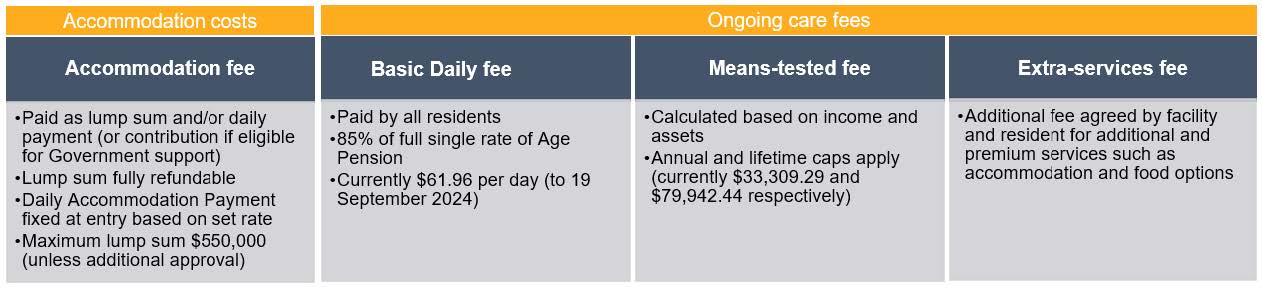

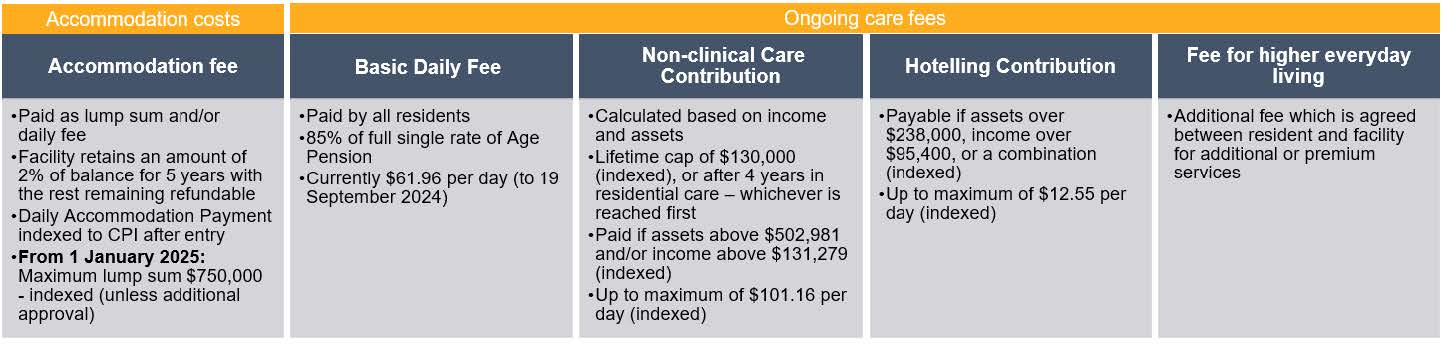

The proposed changes affect both residential accommodation fees and ongoing residential care fees.

Accommodation fees

Accommodation fees are the cost of the ‘room’. You can pay this fee either as a lump sum (commonly called a “bond” or “refundable accommodation deposit” or “RAD”) or as a non-refundable daily fee (known as a “daily accommodation payment” or “contribution”).

Currently, if you leave aged care, any lump sum you’ve paid is usually refunded minus any agreed-upon deductions for other fees.

Although there is no limit on the lump sum that can be charged for a room, a facility can only charge above a certain amount with approval from the Aged Care Pricing Authority.

Proposed changes to accommodation fees include:

- Raising the maximum RAD a facility can charge without approval to account for inflation.

- Introducing a “retention amount,” which allows aged care providers to retain a portion of the lump sum paid, reducing the amount refunded when you leave.

- Adjusting specific daily fees during your stay to keep up with increasing costs.

Ongoing care fees

Ongoing care fees cover the day-to-day care costs, such as meals, bathing, and other services during your stay. The graphic below expands upon this.

Proposed changes to ongoing care fees include:

- Introducing a “Hotelling Contribution” for those with income and assets above set limits to help cover the cost of care.

- Replacing the existing “Means-tested Fee” with a “Non-Clinical Care Contribution,” with the government covering the total cost of clinical care for all residents.

Current Entry Structure

Proposed 1 July 2025 Entry Structure

Introduction of a Retention Amount

Currently, any lump sum paid as a refundable accommodation deposit (RAD) is fully refundable unless you authorise the facility to deduct other fees.

Starting from 1 July 2025, facilities will introduce a “retention amount,” meaning 2% per year (up to five years) will be deducted from the lump sum you pay. This deduction will be calculated daily and charged no more than once per month.

Increase in Maximum Lump Sum Accommodation Deposit

The current maximum amount a facility can charge as a RAD without needing special approval from the Aged Care Pricing Authority is $550,000. Since 2014, this cap has not been adjusted for inflation or rising construction costs. While some facilities charge more for certain rooms, obtaining the necessary approval can be lengthy.

The government proposes increasing the RAD limit to reflect the rising accommodation costs. From 1 January 2025, the maximum amount that can be charged (for new residents) without specific approval will increase to $750,000, with annual indexing beginning on 1 July each year. This change does not require new legislation, as the current rules allow the Aged Care Pricing Authority to adjust the amount when needed.

Facilities will still be able to offer cheaper rooms, with different room options, as they do today.

New Hotelling Contribution or Non-Clinical Care Contribution

When you enter care, an assessment will determine your required contribution based on your income and assets (as assessed for aged care purposes). This process is expected to be managed by Services Australia in the same way as the current system. If you are part of a couple, the assessment will also consider your spouse’s income and assets.

We are here to help

While these proposed changes still need to be passed by Parliament to become law, clients have asked if entering aged care before the 1 July 2025 cut-off date would be beneficial. Several factors should be considered when choosing the right time to enter care. These include:

- Completing the assessment process to confirm eligibility for residential aged care, which is based on factors like your health, mobility, and support needs.

- The availability of your preferred room in a facility that meets your specific requirements, including lifestyle, care, religious, cultural, and geographical considerations.

Moving into residential aged care is a significant life transition that can be emotionally challenging. It’s crucial not to rush the decision and to engage in thorough planning. Seeking advice from professionals such as ourselves is not just a suggestion but a crucial step to help ensure your affairs are in order and that you achieve the best possible outcomes.

Additionally, it’s essential to consider the Government’s new ‘Support at Home’ program, a beacon of hope designed to help ageing Australians stay in their homes longer by offering various care and support options. This could be a viable choice if you wish to maintain your independence at home.

Understanding the aged care system and its interaction with social security and other rules is complex. Before making any decisions, please contact us to discuss how these changes may affect you financially and your lifestyle.

Further reading

See our general information about Aged care planning and assistance.

The government has issued a PDF handout illustrating how fee contributions may vary for full Age Pensioners, part Age Pensioners, and self-funded retirees.