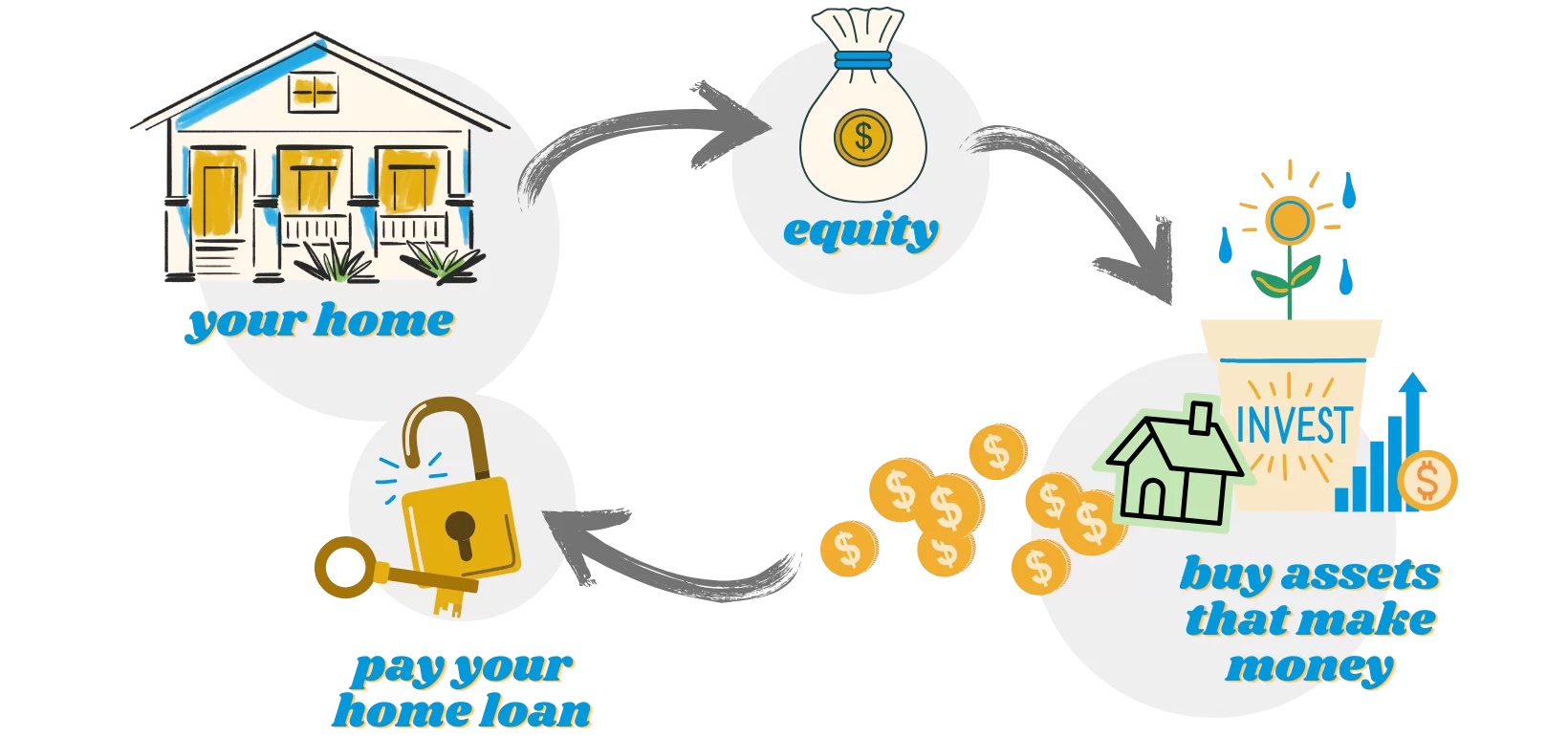

This strategy may enable you to start building wealth while you are still paying off your home mortgage. You effectively take out equity from your home and invest somewhere else, where you may potentially increase income and growth.

Income from these new investments can be used to reduce the mortgage balance further, while the growth component contributes to wealth accumulation.

The main benefit is that you can invest immediately rather than waiting for the mortgage to be paid off. This allows the power of compounding earnings to start working earlier.

WARNING: Although gearing can deliver benefits, the risks associated with it may make it unsuitable for you. It is essential to carefully consider these risks before proceeding with a gearing strategy.

How it works

This strategy involves transferring your non-deductible debt of a home loan into a tax-deductible debt of an investment loan. The primary objective is to reduce the non-deductible debt faster than just making regular repayments while accumulating wealth.

After the interest is paid on the investment loan (line of credit), all surplus cash flow is used to reduce a non-deductible home loan, thereby more rapidly increasing equity in the home.

Home loan repayments are ‘Principal and Interest’ while the investment loan payments are usually ‘Interest Only’ to ensure that non-deductible debt is repaid earlier and that deductible debt works to the maximum. All investment earnings, franking credits, tax refunds and other surplus cash flow, after paying the investment loan interest, should be used to reduce the home loan further and increase equity in the home. Over time, amounts equivalent to the increase in equity can be drawn down and invested in growth investments further, if desired (depending on your life stage and objectives). If the above process is repeated over future years in a disciplined manner, it can reduce the non-deductible home loan more rapidly whilst increasing investments into growth assets.

A loan facility allowing separate sub-accounts is preferred, with the ability to choose between principal and interest and interest-only repayments. As some of the investment debt will have deductible interest costs, these amounts should be kept separate.

To commence a debt recycling strategy, you need to ensure you are able to achieve a desirable loan structure. Please contact our finance team to review your finance structure and product.

Debt Recycling in practice

In this example, you have a mortgage of $500,000 against a home worth $800,000 and an offset / redraw balance of $100,000 against this loan.

To set up a debt recycling strategy:

— You would first contact our finance team to put in place a new loan.

— You would first pay the $100,000 against your home loan directly

— Then take out a new investment loan against your home for $100k.

— Use these funds to purchase a diversified share portfolio.

Example Assumptions:

- The home loan interest rate is 6.5%, and there is 20 years left to repay.

- Investment Debt interest rate is 7% and is interest only.

- Dividend income is 6% per annum and is 50% franked.

- Assume Capital Growth is 2% — this would fluctuate due to the risk of the investment, some years being better, some years negative.

As you can see, your net asset position hasn’t changed as you have effectively just used the funds from your offset / redraw to invest into a share portfolio.

You would receive dividend income from the share portfolio that can be used to pay down non-deductible debt.

Please note that the franking credits are not cash credits but only tax credits, which are discussed below.

Before this strategy you would need to just pay down your home loan repayments. These repayments would be principal and interest.

Under the strategy, your home loan repayments would decrease as you have paid down the balance.

The investment property debt would be interest only.

You will increase your cash flow position by almost $8k per year to further reduce non-deductable debt.

You will have to declare the dividend income and the franking credits as income, but you will be able to deduct the interest-only repayments as a deduction. You then get the franking credits back as a tax credit, meaning you will receive a decrease to your tax bill or an increase to your refund by $1,200.

These funds can then also be used to further reduce your non-deductible debt.

The share portfolio will continue to grow over time. Please note the risks below, as due to the nature of the investments, there is a chance that capital returns in some years may be negative. For risk, there is a return.

Example:

Asset Position |

Current | After Strategy |

| Home Value | $ 800,000.00 | $ 800,000.00 |

| Share Portfolio | $ – | $ 100,000.00 |

| Offset Redraw | $ 100,000.00 | $ – |

| Total Assets | $ 900,000.00 | $ 900,000.00 |

Debt Position |

||

| Total Home Loan (non deductable debt) | $ 500,000.00 | $ 400,000.00 |

| Total Investment Debt (deductable debt) | $ – | $ 100,000.00 |

| Total Debt | $ 500,000.00 | $ 500,000.00 |

| Net Asset Position | $ 400,000.00 | $ 400,000.00 |

Income per year |

||

| Dividends from Shares | $ – | $ 6,000.00 |

| Franking Credits (non-cash income) | $ – | $ 1,285.71 |

Expenses per year |

||

| Loan Repayments on home loan 6.5% | ($ 44,734.39) | ($ 35,787.51) |

| Loan Repayments on investment loan | $ – | ($ 7,000.00) |

Net Cashflow Position |

($ 44,734.39) | ($ 36,787.51) |

| Difference (can be used to repay home loan /non-deductible debt further) |

$ 7,946.88 |

|

Potential Gain on Share Portfolio |

||

| Unrealised | $ – | $ 2,000.00 |

Benefits

Benefits of debt recycling may include:

- You can invest immediately rather than waiting for the mortgage to be paid off. This allows the power of compounding earnings to start working earlier.

- By channelling your investments and other available income into a home loan, you have the potential to reduce it faster, leading to significant savings on interest. This can be a powerful motivator to consider debt recycling.

Although gearing can deliver benefits, the risks associated with it may make it unsuitable for you. It is essential to carefully consider these risks before proceeding with a gearing strategy.

- Borrowing to invest can be tax-effective because the interest is deductible. This will reduce the strategy’s net cost to you. The higher your marginal tax rate, the more profitable this strategy is.

- Gearing can provide a diversified approach to creating wealth for your retirement.

Risks, consequences and other important things to consider

These include:

- Debt recycling can lead to compounding losses when markets experience a downturn.

- Interest rates associated with loan facilities used in debt recycling strategies are often higher than the standard variable mortgage rate.

- Debt recycling is not recommended for anyone with an investment timeframe of less than seven years.

- It is a risky strategy, only suited to investors with a reasonable risk tolerance and a secure income source.

- You should have adequate life insurance to help meet loan repayments if your income stops because of death or illness.

For a downloadable PDF version of this page, click here.

If you are considering debt recycling or any other personalised finance product, it is crucial to seek professional advice. Our team is ready to provide you with specific advice tailored to your financial situation.