If you’re similar to many individuals, you might wonder, “Will my super account hold enough for a comfortable retirement?” or “What’s the ideal amount of super to aim for at my current age?”

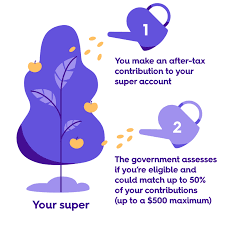

There are primarily two methods for contributing to your superannuation: concessional and non-concessional. Concessional contributions involve allocating pre-tax dollars to your superannuation account, while non-concessional contributions are made with after-tax funds.