The major change to affect clients is the Downsizer Contribution being reduced to the age of 55 from 60.

Superannuation, in our view, still remains the most tax-effective structure and provides the opportunity for many clients to work towards a tax-effective and tax-free retirement.

‘Downsizer’ eligibility reduced to 55 (From the First quarter after Royal Assent)

As previously announced, the Government will reduce the age at which an individual can make a ‘downsizer’ contribution to superannuation from the current 60 to 55 years of age.

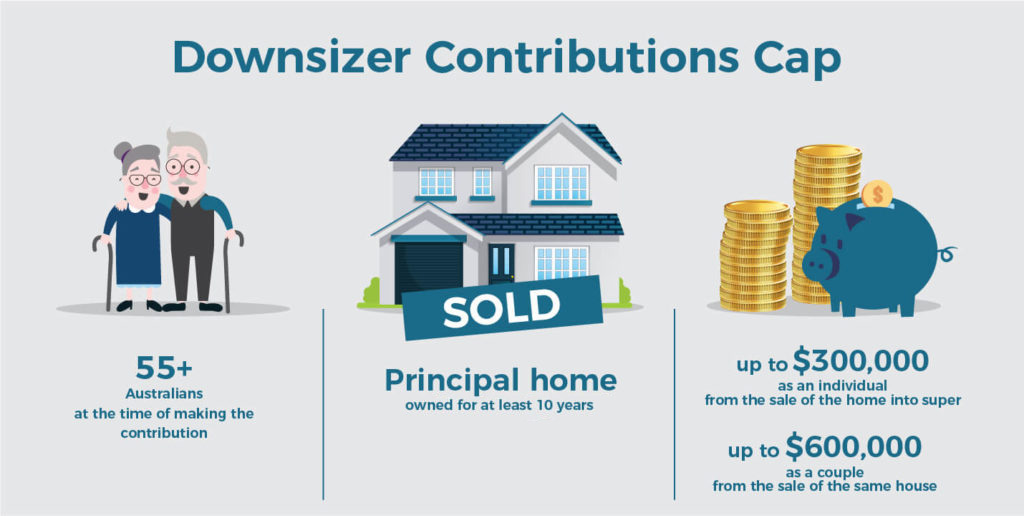

Currently, eligible individuals aged 60 years or older can choose to make a ‘downsizer contribution’ into their superannuation of up to $300,000 per person ($600,000 per couple) from the proceeds of selling their home.

You can make downsizer contributions from the sale of your principal residence in Australia that you have owned for the past ten or more years. These contributions are excluded from the age test, work test, and your total superannuation balance (but not exempt from your transfer balance cap).

This means that a couple who sells their home to downsize can contribute up to $300,000 each, plus the non-concessional cap of $110,000 annually. So, you could potentially sell your home, downsize and then contribute $630,000 each into super to increase your superannuation balance.

Legislation enabling the expanding eligibility for downsizer contributions is currently before Parliament.

Delayed: Relaxation of SMSF residency requirements.

The 2021-22 Budget announced that the residency rules for Self-Managed Superannuation Funds (SMSFs) and small APRA-regulated funds (SAFs) would be relaxed by extending the central control and management test safe harbour from two to five years for SMSFs and removing the active member test for both fund types.

The 2021-22 Budget announced that the residency rules for Self-Managed Superannuation Funds (SMSFs) and small APRA-regulated funds (SAFs) would be relaxed by extending the central control and management test safe harbour from two to five years for SMSFs and removing the active member test for both fund types.

This measure was due to commence on 1 July 2022. The Government has announced that it will defer the start date to the income year beginning on or after the date of Royal Assent of the enabling legislation.

Scrapped: 3-year SMSF audit requirement.

Back in the 2018-19 Budget, the Government announced that SMSFs with a history of good record-keeping and compliance – that is, three consecutive years of clear audit reports and annual returns lodged on time, will only be required to have their fund audited every three years.

The Government has now officially announced that this measure will not be proceeding.

Change to taxation of off-market share buy-backs by listed companies (From 7:30 pm AEDT, 25 October 2022)

From Budget night, 7:30 pm AEDT, 25 October 2022, the Government intends to align the tax treatment of off-market share buy-backs undertaken by listed public companies with the treatment of on-market buy-backs. The result is expected to deliver a saving of $550m.

From Budget night, 7:30 pm AEDT, 25 October 2022, the Government intends to align the tax treatment of off-market share buy-backs undertaken by listed public companies with the treatment of on-market buy-backs. The result is expected to deliver a saving of $550m.

An on-market buy-back is when a listed company repurchases its shares on the stock exchange. All other buy-backs are treated as off-market buy-backs.

Under the current rules, when a company undertakes an off-market buy-back, it is necessary to consider which portion of the proceeds is taxed as a dividend and which part is taxed under the CGT rules. Franking credits can potentially be attached to the dividend component.

On the other hand, when a listed company undertakes an on-market buy-back, the entire proceeds are generally taxed under the CGT rules, and franking credits cannot be passed onto the shareholders.

Off-market buy-backs potentially offer a tax advantage to low-taxed shareholders such as superannuation funds. It appears that the Government has become concerned that the difference in the tax treatment between on-market and off-market buy-backs has been exploited inappropriately.

The Budget measure only refers to listed public companies, which presumably means that the current tax treatment for off-market buy-backs undertaken by private companies and public companies that are not listed will continue to apply.

While this measure is yet to be legislated, with a Budget night implementation date, this could have an immediate tax impact on the treatment of new off-market share buy-backs.

The 2021-22 Budget announced that the residency rules for Self-Managed Superannuation Funds (SMSFs) and small APRA-regulated funds (SAFs) would be relaxed by extending the central control and management test safe harbour from two to five years for SMSFs and removing the active member test for both fund types.

The 2021-22 Budget announced that the residency rules for Self-Managed Superannuation Funds (SMSFs) and small APRA-regulated funds (SAFs) would be relaxed by extending the central control and management test safe harbour from two to five years for SMSFs and removing the active member test for both fund types. From Budget night, 7:30 pm AEDT, 25 October 2022, the Government intends to align the tax treatment of off-market share buy-backs undertaken by listed public companies with the treatment of on-market buy-backs. The result is expected to deliver a saving of $550m.

From Budget night, 7:30 pm AEDT, 25 October 2022, the Government intends to align the tax treatment of off-market share buy-backs undertaken by listed public companies with the treatment of on-market buy-backs. The result is expected to deliver a saving of $550m.