| Insurance Requirements Over Lifecycle |

No matter how comprehensive and successful your investment plan may be, the most important asset you and your family have is your health. Without it, you lose your ability to provide for yourself and your family on a day-to-day basis, let alone achieve your long-term goals.

Being injured, or worse, dying prematurely, are subjects we would prefer to keep at the back of our minds. By taking out insurance, you can afford to concentrate on living, knowing that if the worst happens, you and your family will be protected.

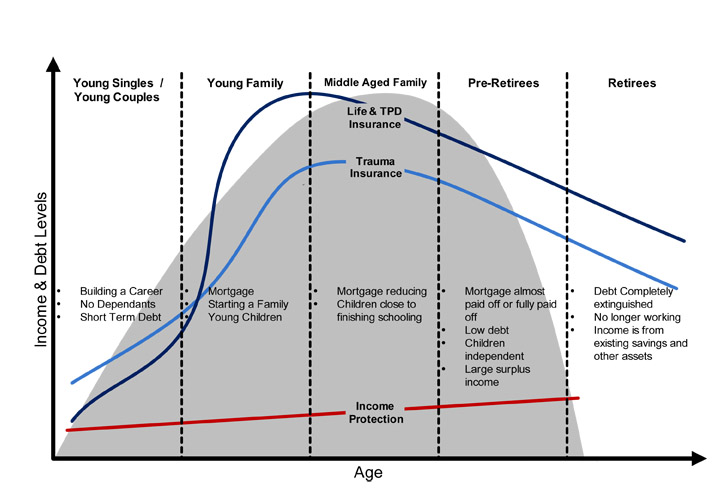

The graph below illustrates how the ideal amount of personal insurance coverage can change over time as you move through different life stages.

| Types of cover |

Life Cover

Also known as ‘term life’ or ‘death cover’, life cover as the name suggests, pays a set amount of money when you die. This money will go to the people you nominate as beneficiaries on your policy.

Total and Permanent Disability Cover (TPD)

TPD pays a lump sum to assist with rehabilitation costs, debt repayments and future living costs if you are totally and permanently disabled. TPD is often bundled with life cover. It is important to note that TPD is usually offered in 2 definitions, ‘own’ or ‘any’. TPD ‘own’ means that you cannot work again in your usual or own occupation. TPD ‘any’ means that you cannot work in any occupation. For this reason, TPD ‘own’ cover is more expensive.

Trauma Cover

Trauma provides cover if you are diagnosed with a specified illness or injury. These policies include the major illnesses or injuries that will make a significant impact on your life, such as cancer or a stroke. It is also referred to as ‘critical illness cover’ or ‘recovery insurance’.

Income Protection

Income Protection Insurance can provide you with up to a 70 per cent replacement income if you are unable to work due to illness or injury.

Income protection insurance is designed to replace your income based on your annual earnings in the 12 months prior to your illness or injury.

You can spend the benefits as you choose, and premiums are tax-deductible, reducing the overall cost of your insurance.

See more here.

| Some Terms You Should Know |

Income Protection Insurance versus Workers Compensation Insurance

Income Protection is a better cover than Workers Compensation. It provides overall cover, whereas Workers Compensation only covers work accidents and injuries that occur at work. Workers compensation generally does not cover time off work due to illness or accidents that occur outside of the workplace.

Indemnity versus Agreed Value

Income protection policies are either an:

Indemnity value policy — the amount you’re insured for is a percentage of your salary when you make a claim. If your salary has decreased since you bought the policy, you’ll get a smaller monthly insurance payment. If your income is variable, your insured amount will be based on average annual earnings over a period of time appropriate for your occupation.

Agreed value policy — the amount you’re insured for is a percentage of an agreed amount when you sign up for the policy. These are generally more expensive but can be useful if you have income that changes from year-to-year.

From 31 March 2020, insurers can no longer offer agreed value policies to new customers. If you purchased an agreed value policy before this date, you can continue to hold this policy. If you decide to change policies, you will only be able to purchase an indemnity value policy.

See more here.

Standard versus Comprehensive Cover

Standard cover only covers basic features such as the benefit are payable in the event of total disability, partial disability, rehabilitation and unemployment.

Comprehensive cover covers in addition to the basic cover which includes accommodation, family support, home care and specific injuries benefits. Hence, the premium for a comprehensive cover is higher compared to the standard cover.

Cancellable Income Protection Insurance is a policy which may be cancelled and covers you for a short period. The insurance is available from a general insurer. Cancellable income protection insurance may be cancelled at the time of renewal by the insurance company as a result of a health risk, such as a heart attack or development of cancer during the year. This type of insurance is particularly useful to professional sportspersons who may be playing a different sport, or for another club, during the off-season from their usual team.

Non-Cancellable Income Protection Insurance is a policy which guarantees cover to a selected expiry date in return for payment of a premium. Only the insured can void the policy by way of cancellation letter or non-payment of premiums. You must consider Income Protection insurance to assist in covering your financial commitments to ensure that sickness or accident will not create undue hardship or jeopardise your lifestyle.

Waiting period

This is the amount of time you must wait before your payments start. Most income protection policies offer a waiting period between 14 days and two years.

You must be unable to work as a result of your illness or injury at the end of the waiting period to be eligible for payments.

In general, the longer the waiting period, the cheaper the policy.

When you’re choosing the waiting period, think about how much you have in sick and annual leave, savings and emergency funds.

Benefit period

The benefit period is how long the monthly payments will last if you remain unable to work due to your illness or injury.

Most income protection policies offer two or five years, or up to a specific age (such as 65).

The longer the benefit period, the more expensive the policy. But it also means greater protection if you’re unable to work for a longer time.

Underwriting

Underwriting is the process the insurance company takes to evaluate the risk they are taking by insuring you. Underwriting is specific to your personal health, lifestyle, occupation and extra curricular activities.

Each of the above categories has a scale from low risk through to high risk, which will have a direct affect on the premiums you pay. When it is deemed by the insurer that there is excess risk to insure you as an individual, they will generally charge a loading on your premium to account for these additional risks.

Some examples of things that could increase your premiums include being overweight, have prior medical conditions, being a smoker or heavy drinker, working in an occupation deemed higher risk or if you are involved in sports or hobbies that may increase your chance of injury, sickness or death.

Total and Permanent Disability Definitions: Any vs Own

Any Occupation

‘Any’ occupation definition is where the insurer takes into account all of your training and experience you may have when determining the extent of your disability, and your ability to be engaged in employment for which you are trained. Generally, this is any job (so you can be over qualified for a lower skilled occupation).

Generally, the benefit will only be paid if you are not able to engage in employment in any occupation that you are reasonably qualified for regardless of your occupation at the time the claim is made.

Any occupation can be held inside superannuation and outside superannuation.

The premium is generally cheaper, but it has a higher threshold to claim (that is, you are unable to do any job that you are qualified for), and as such, it is less likely that the insurer will payout.

Own Occupation

‘Own’ occupation provides a superior definition of TPD insurance. It generally means that you receive your insurance payout if you are deemed to be unable to work again in the job you were working in as your occupation prior to your disability. This cover is more expensive as it is easier to show that you are not able to work in the job that you were qualified for and working in before disability.

For example, if you hold a qualification (either university or TAFE / trade), and you can not longer do that particular qualification, but you can work in general retail (like stacking shelves) then you would not meet the definition of Any Occupation, but you would meet the definition of Own Occupation.

Own occupation can only be held in your personal name.

Life Insurance and TPD can be held inside superannuation, as it is held to provide benefits on the death or disability of a member of a superannuation fund.

But, there are two issues that need to be considered:

a) The TPD definition of your insurance policy; and

b) The TPD definition for superannuation funds to release the payout.

There have been cases where an Own Occupation policy has been held inside a superannuation fund. The problem with this holding structure is that in the event that there is a claim made, the insurance proceeds are paid by the Life Insurance Company to the Superannuation Fund. But, the Superannuation Fund is not allowed to payout the insurance proceeds (as they become part of the superannuation balance) as the TPD definition for Own Occupation generally does not satisfy the Superannuation Industry (Supervision) Act 1993, and the related regulations.

Generally (and for any new policies taken out) Any Occupation is held in Super, and Own Occupation can only be held outside Super.

TPD Superlinked:

A number of insurers are acutely aware of the desire for clients to hold an Own Occupation policy, but to have the tax benefits and cashflow of an Any Occupation policy.

The Super-Linked TPD policy was developed in response to the need arising to have a policy that covers both situations.

A Super-linked Policy allows you to split your TPD insurance into two components.

1. Any occupation portion would sit inside of super; and

2. Own occupation portion would sit outside of super.

If you were to make a claim, you would first be assessed under the any occupation definition. If you qualify under this definition, then the benefit amount would be paid into your superfund then to the person insured.

If you don’t qualify for the benefit payment under the any occupation definition, then the insurer will next assess you under the own occupation definition which is held in your personal name. If you then qualify under the own occupation, you will then be paid the benefit directly rather than it having to go through super.

Insurance Premiums – Tax Deductability:

We normally suggest that if your personal cashflow allows have your Income Protection insurance paid out of your own pocket as its tax deductible to you.

Only the premiums you pay to protect your income are deductible against your taxable income each year. Any payment you then receive under an income protection policy must be included and claimed in your Income tax return, as this will be assessable income. The amount that you are able to be covered is generally only 75% of your income as well. So, that is the amount that you receive which will be taxable.

If you are unable to afford the premium personally, we recommend considering a policy that is linked to your superannuation. A Super-Linked policy is paid partly inside super and party outside super or 100% owned by super.

However, if the policy is taken out through your superannuation fund and the premiums are deducted from the superfund, you are not able to claim this as a tax deduction in your own name.

| Insurance Type | Tax Deductible Super | Tax Deductible Personal | Not Deductible (Either) |

| Life Insurance Super | YES | ||

| Life Insurance Personal Name | NO | ||

| TPD Super | YES | ||

| TPD Personal | NO | ||

| Income Protection Super | YES | ||

| Income Protection Personal | YES | ||

| Trauma (Critical Illness) | NO |

Premium Structure

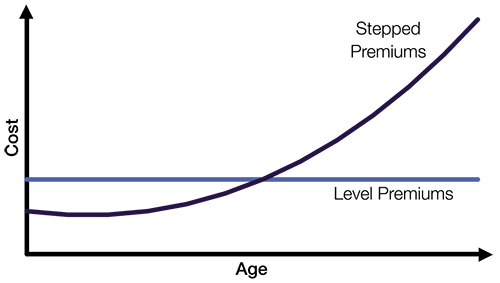

Insurance premiums are usually available in two forms:

- Stepped Premiums: Whereby the insurance costs increase each year in accordance with your age.

- Level Premiums: Whereby your insurance premiums are constant year to year.*

*Most companies reserve the right to increase level premium rates, so it is not guaranteed that premiums will remain the same each year.

Stepped premiums are usually lower in the early years of insurance, but level premiums may be more cost effective over the longer term.

We usually recommend a stepped premium structure as it allows you to obtain the required amount of insurance whilst minimising the impact on overall cash flow. Over time we generally review your level of cover to determine if it is sufficient and potentially reduce it as you build up more assets.

| Next Step |

As life progresses, your financial circumstances will change. This could be the arrival of a child, the purchase of a property or a new job. When these changes occur, it is important to understand how this may impact your financial situation. Making sure you have sufficient coverage to protect you and your family is imperative for your long-term financial security and peace of mind.

If you are unsure about the levels of cover you require or feel you need to change your level of cover to be adequately protected, please get in contact with us and we will run a full insurance needs analysis for you.

Important information and disclaimer

This publication has been prepared by AustAsia Group, including AustAsia Financial Planning Pty Ltd (AFSL 229454).

Any advice in this publication is general only and has not been tailored to your circumstances. Accordingly, reliance should not be placed on the information contained in this document as the basis for making any financial investment, insurance, or other decision. Please seek personal advice before acting on this information.

Information in this publication is accurate as at the date of writing, 9 April 2024. Some of the information has been provided to us by third parties. While it is believed the information is accurate and reliable, the accuracy of that information is not guaranteed in any way.

Opinions constitute our judgement at the time of issue and are subject to change. Neither the Licensee nor any member of AustAsia Group, nor their employees or directors give any warranty of accuracy, nor accept any responsibility, for any errors or omissions in this document.

Any general tax information provided in this publication is intended as a guide only and is based on our general understanding of taxation laws. It is not intended to be a substitute for specialised taxation advice or an assessment of your liabilities, obligations or claim entitlements that arise, or could arise, under taxation law, and we recommend you consult with a registered tax agent.