The Fringe Benefits Tax (FBT) year ends on 31 March. We’ve outlined the hot spots for employers and employees.

FBT exemption for electric cars

Employers that provide employees with the use of eligible electric vehicles (EVs) can potentially qualify for an FBT exemption. This should generally be the case where:

- The car is a zero or low-emission vehicle (battery electric, hydrogen fuel cell or plug-in hybrid electric);

- The car is both first held and used on or after 1 July 2022; and

- The car’s value is below the luxury car tax threshold for fuel-efficient vehicles (which is $89,332 for the 2024-25 financial year).

Plug-in hybrid vehicles are no longer FBT-exempt.

From 1 April 2025, plug-in hybrid electric vehicles will no longer qualify for the FBT exemption unless:

- The use of the vehicle was exempt before 1 April 2025, and

- There is a financially binding commitment to continue providing private vehicle use on and after 1 April 2025.

If that commitment is broken or changed on or after 1 April 2025, the exemption will typically no longer be available.

Working with the exemption

Even if the FBT exemption applies, your business will still need to work out the taxable value of the benefit as if the FBT exemption didn’t apply. This is because the exempt benefit’s value is still considered when calculating the employee’s reportable fringe benefits amount. While income tax is not paid on this amount, it can impact the employee in various areas (such as the Medicare levy surcharge, private health insurance rebate, employee share scheme reduction, and social security payments).

This means the employee’s own home electricity costs incurred on charging the electric vehicle will often need to be worked out. This figure can generally be treated as an employee contribution to reduce the value of the benefit.

While this can be practically difficult to determine, the ATO has issued some guidelines that provide a 4.20 cent per km shortcut rate that could help with the calculation. These guidelines do not apply to plug-in hybrid vehicles.

Many electric vehicles are also packaged together with electric charging stations. Just be aware that the FBT exemption for electric cars does not extend to charging stations provided at the employee’s home.

See our previous article on FBT Exemption for electric cars

Providing equipment to work from home

Many businesses continue to offer flexible work-from-home arrangements. Employees are often provided with work-related items to assist them in working from home. In general, where work-related items are provided to employees and used primarily for work, FBT shouldn’t apply.

For example, portable electric devices such as laptops and mobile phones provided to employees shouldn’t trigger an FBT liability as long they are primarily used by your employees for work. Multiple similar items can also be provided during the FBT year where required – for example, multiple laptops have been provided to the employee – but only if the business has an aggregated turnover of less than $50m (previously, this threshold was less than $10m).

If the employee uses equipment the business provides for their own private use, FBT usually applies to the private use. However, the FBT liability can be reduced based on the business use percentage.

Does FBT apply to your contractors?

The FBT rules tend to apply when benefits are provided to employees and certain officeholders, such as directors. FBT should not apply when benefits are provided to genuine independent contractors, but you need to be sure that your contractors are, in fact, contractors.

Are your contractors really contractors?

Following two landmark decisions handed down by the High Court, the ATO has now finalised a ruling TR 2023/4 that helps determine whether a worker is an employee or an independent contractor.

If the parties have entered into a written contract, then you need to focus on the terms of that contract to establish the nature of the relationship (rather than looking at the parties’ conduct). However, merely labelling a worker as an independent contractor doesn’t necessarily mean that they won’t be treated as an employee if the contract terms suggest that the parties have entered into an employment relationship.

The ATO has also issued PCG 2023/2, which sets out four risk categories. Arrangements will tend to be viewed in a more favourable light where:

· There is evidence to show that you and the worker have agreed on the classification;

· There is a comprehensive written agreement that governs the relationship;

· There is evidence that you and the worker understand the consequences of the classification;

· The performance of the arrangement hasn’t deviated significantly from the terms of the contract;

· Specific advice has been sought confirming that the classification is correct; and

· Tax, superannuation, and reporting obligations have been met when the worker is classified as an employee or independent contractor (whichever is relevant).

If your business employs contractors, you should have a process to ensure the correct classification of the arrangements and to determine the ATO’s risk rating. These arrangements should also be reviewed over time.

Even when a worker is a genuine independent contractor, remember that this doesn’t necessarily mean the business won’t have at least some employment-like obligations to meet. For example, some contractors are deemed to be employees for superannuation guarantee and payroll tax purposes.

Reducing the FBT record-keeping burden

Record keeping for FBT purposes can be onerous. From 1 July 2024, however, your business will have a choice to keep the existing FBT record-keeping methods, use existing business records where those records meet the requirements set out by the legislative instrument, or a combination of both methods:

- Travel diaries – see LI 2024/11

- Living-away-from-home-allowance – FIFO/DIDO declarations – see LI 2024/4

- Living-away-from-home – maintaining an Australian home declaration – See LI 2024/5

- Otherwise deductible rule – expense payment, property or residual benefit declaration – See LI 2024/6

- Otherwise deductible rule – private use of a vehicle other than a car declaration – See LI 2024/7

- Car travel to an employment interview or selection test declaration – See LI 2024/14

- Remote area holiday transport declaration – See LI 2024/10

- Overseas employment holiday transport declaration – See LI 2024/13

- Car travel to certain work-related activities declaration – See LI 2024/9

- Relocation transport declaration – See LI 2024/12

- Temporary accommodation relating to relocation declaration – See LI 2024/8

FBT housekeeping

It can be challenging to maintain the required records concerning fringe benefits, especially as this may depend on employees producing records at a specific time. If your business has cars and you need to record odometer readings on the first and last days of the FBT year (31 March and 1 April), remember to have your team take a photo on their phone and email it to a central contact person – it will save running around to every car or missing records where employees forget.

The top FBT risk areas

Mismatched claims for entertainment – claimed as a deduction but no FBT

One of the easiest ways for the ATO to pick up on problem areas is where there are mismatches.

Regarding entertainment, employers are often keen to claim a deduction, but this can be a problem if it is not recognised as a fringe benefit provided to employees. Expenses related to entertainment, such as a meal in a restaurant, are generally not deductible, and no GST credits can be claimed unless the expenses are subject to FBT.

Let’s say you taken a client out to lunch and the amount per head is less than $300. If your business uses the ‘actual’ method for FBT purposes, then there should not be any FBT implications. This is because benefits provided to clients are not subject to FBT, and minor benefits (i.e., a value of less than $300) provided to employees on an infrequent and irregular basis are generally exempt from FBT. However, no deductions should be claimed for the entertainment, and no GST credits would typically be available.

If the business uses the 50/50 method, then 50% of the meal entertainment expenses would be subject to FBT (the minor benefits exemption would not apply). As a result, 50% of the expenses would be deductible, and the business could claim 50% of the GST credits.

Employee contributions by journal entry in the accounts

Many businesses use after-tax employee contributions to reduce the value of fringe benefits. It is also reasonably common for these contributions to be made by journal entry through the accounting system only (rather than being paid in cash).

While this can be acceptable if managed correctly, the ATO has flagged numerous concerns, including whether journal entries made after the end of the FBT year are valid employee contributions.

For an employee contribution made by way of journal entry to be effective in reducing the taxable value of a benefit, all of the following conditions must be met:

- The employee must have an obligation to make a contribution to the employer towards a fringe benefit (i.e., under the employee’s remuneration agreement);

- The employer has an obligation to make a payment to the employee. For example, the parties may agree that the employer will lend an amount to the employee, or the employee might be entitled to a bonus that hasn’t been paid yet. If the employer makes a loan, then this could trigger further tax issues that need to be managed;

- The employee and employer agree to set off the employee’s obligation to the employer against the employer’s obligation to the employee; and

- The journal entries are made no later than the time the financial accounts are prepared for the current year (i.e., for income tax purposes).

Failing to ensure that arrangements involving fringe benefits and employee contributions are clearly documented can lead to problems. For example, the ATO may ask for evidence that the employer is obliged to contribute towards a fringe benefit. If there is no evidence, then significant FBT liabilities could arise.

Not lodging FBT returns

The ATO is concerned that some employers are not lodging FBT returns when required.

Suppose your business employs staff (even closely held staff such as family members) and is not registered for FBT. In that case, it’s essential to review the position to check whether the business could potentially have an FBT liability.

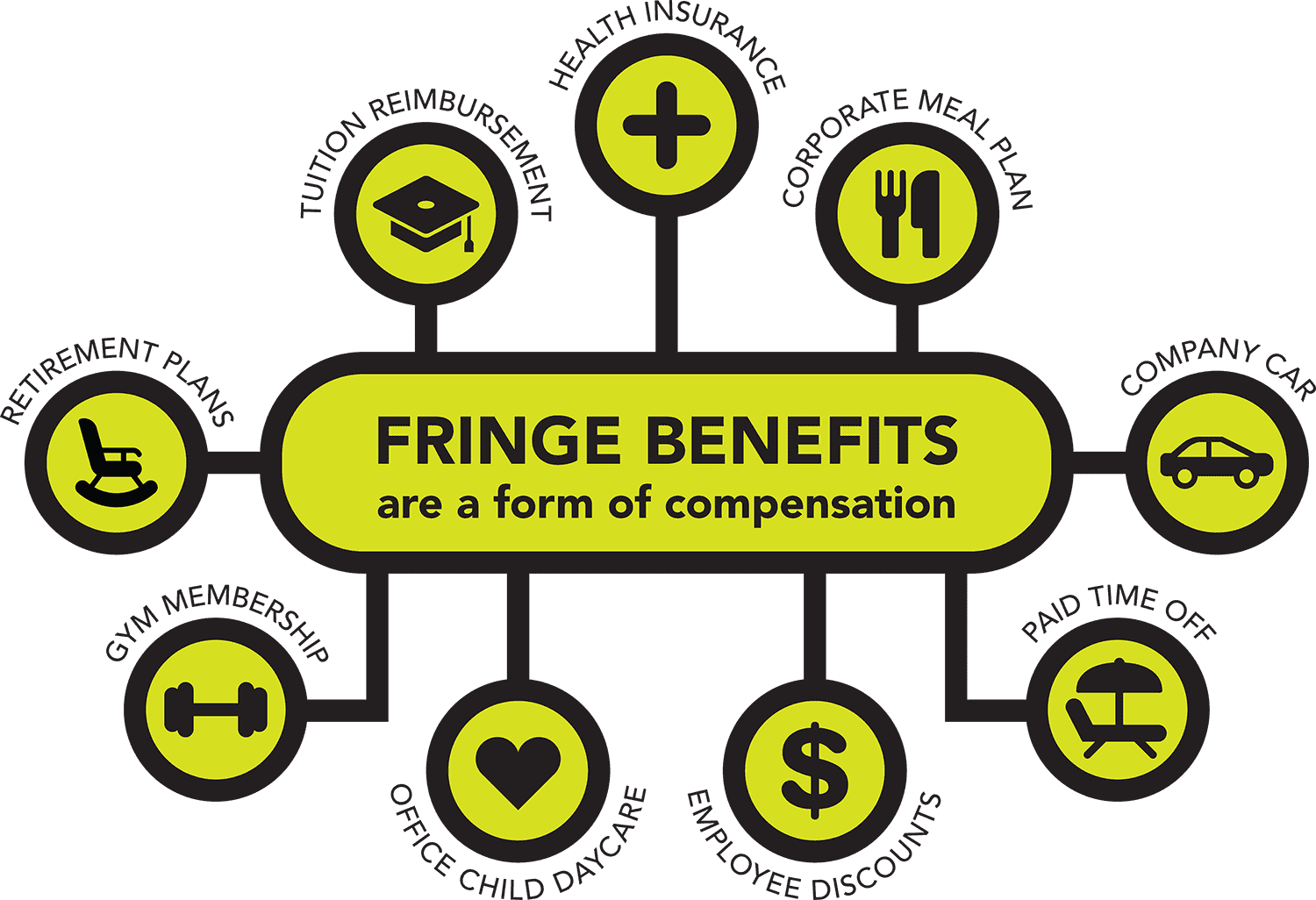

If the business provides cars, car spaces, reimburses private (not business) expenses, provides entertainment (food and drink), employee discounts, etc., you will likely be providing at least some fringe benefits.

There is a list of benefits considered exempt from FBT, such as portable electronic devices like laptops, protective clothing, tools of trade, etc. If your business only provides these exempt items or items that are infrequent and valued under $300, then you are unlikely to have to worry about FBT.

Rest Assured, We Are Here to Help

To lodge your FBT return, please contact us today, and we’ll guide you through the process of lodging your FBT return, making it a hassle-free experience.

We make FBT less taxing!

For a fact sheet article on Fringe benefits Tax, click here.