The ATO Big Brother is watching!

The ATO is increasing their focus on collecting more tax, as the Government is spending more money.

This gives the ATO the ability to analyse the data and use techniques to target audits. The ATO can request information about transactions in your tax returns but can also request why information isn’t in your return. This increase in audit activity usually means that you may have to defend yourself, even though you are not liable for tax. The time taken to respond to ATO queries (and other regulators) can quickly escalate. Some clients have preferred to engage AAG to assist in their responses and protection of their positions.

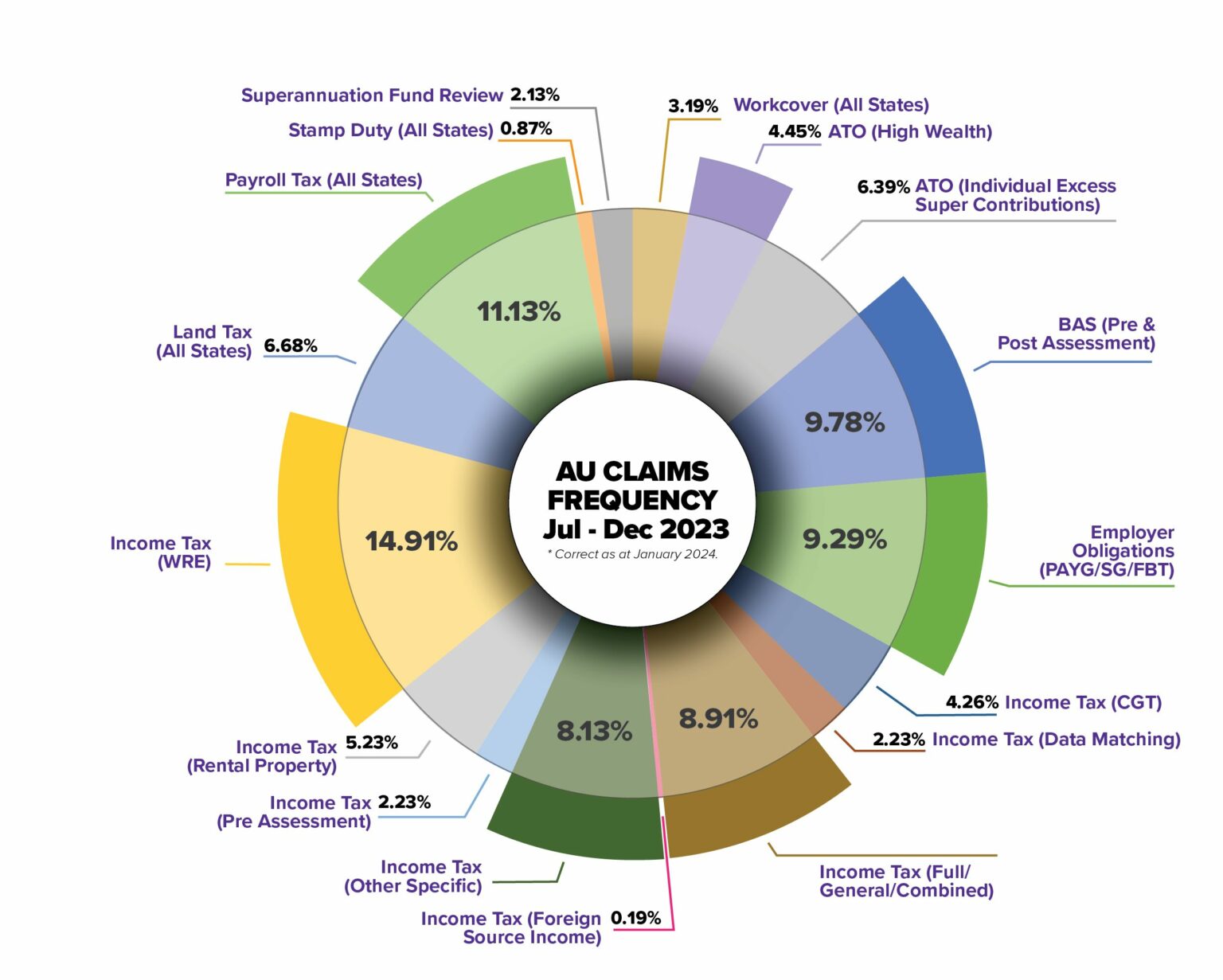

The top 5 ATO Audits for 2023 were:

- Income Tax (Work Related Expenses)

- Payroll Tax

- BAS

- Employer Obligations (PAYG/SG/FBT)

- Income Tax (Full/General/Combined)

For more information on the ATO data-matching programs, please see this link:

https://www.ato.gov.au/General/Gen/Data-matching-protocols/

What is the AustAsia Group doing to assist?

As many clients are aware, AAG has engaged Audit Shield to provide insurance cover for the cost of professional fees, such as ours, in the event you are contacted by the ATO or other revenue related government body for a review or audit.

Audit insurance will cover reviews for both current and prior year lodgements, including but not limited to income tax returns, activity statement audits, fringe benefits tax and payroll tax.

Please see our factsheet on the Audit Shield Service.

Email our Client Care Team for advice on this service if it is appropriate for you.

Should you have any questions on your obligations, don’t hesitate to get in touch with us.