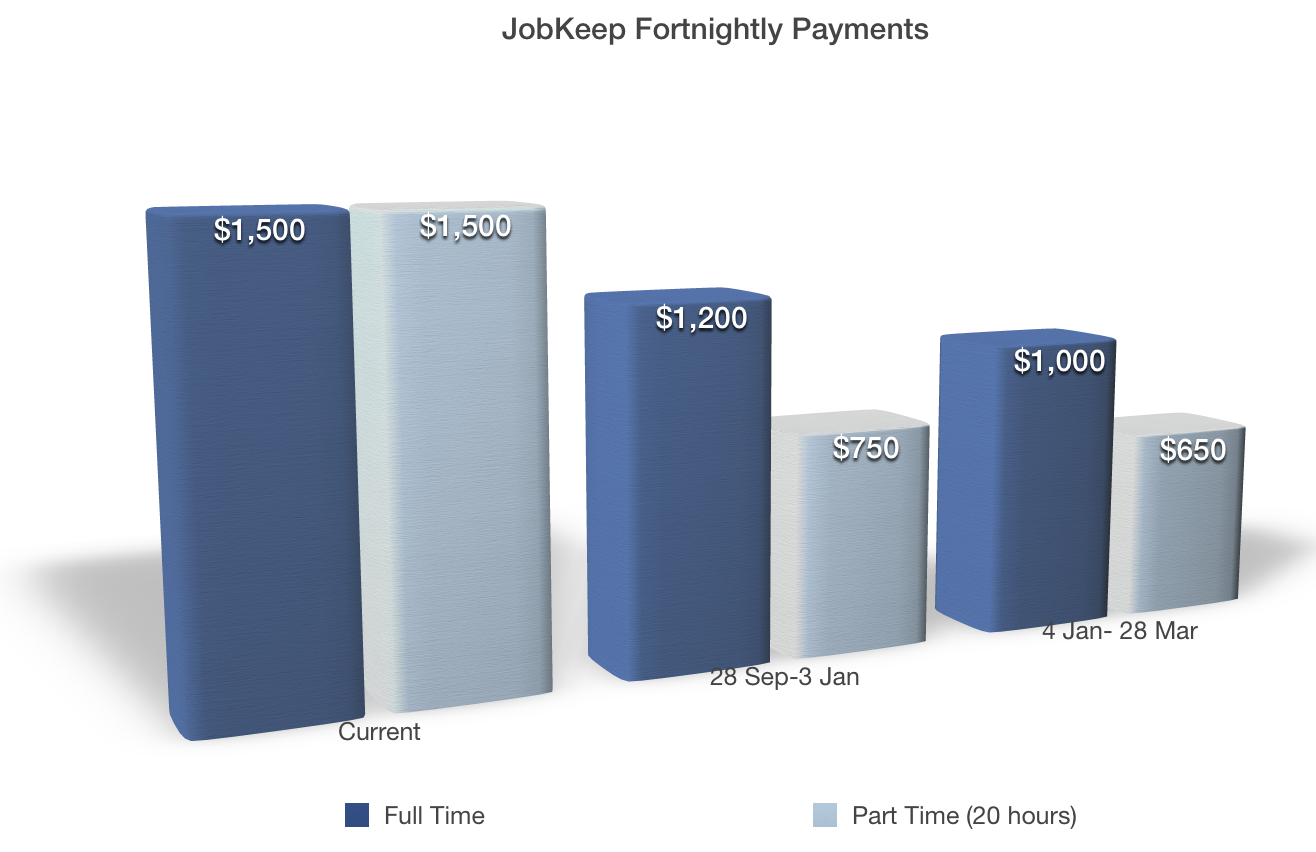

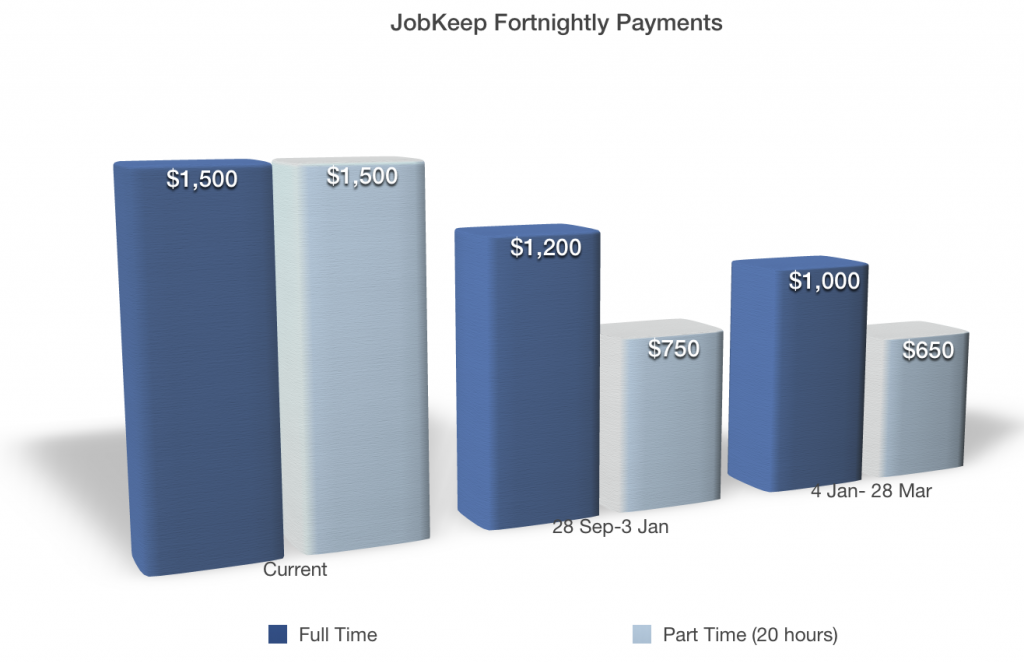

The Federal Government announced that the JobKeeper subsidy will be extended until March, but with reduced rates and a new turnover test. The JobSeeker supplement will continue until 31 December 2020, and has also been reduced.

The JobKeeper will change to a two-tiered payments system based on number of hours worked within a week.

| Date | Full rate per fortnight | Less than 20hrs worked per fortnight rate |

|---|---|---|

| 28 September 2020 to 3 January 2021 | $1,200 | $750 |

| 4 January 2021 to 28 March 2021 | $1,000 | $650 |

Businesses will now need to prove financial hardship on a quarterly basis. GST Turnover quarters ending in June and September will be compared to the same period in 2019. Businesses with aggregated turnover of $1 billion or less will need to show a 30% decline. Large Businesses, those with aggregated turnover of more than $1 billion, will need to show a 50% reduction. For charities, a reduction of 15% is required. To qualify for the 4 Jan – 28 Mar assistance package, Businesses will need to be tested again for the quarter ending 31 December 2020.

If this is not an appropriate test to prove a decline in turnover, the Commissioner of Taxation can be contacted to determine an alternative test.

There are no changes to employee eligibility, and self-employed people continue to be eligible for JobKeeper if they meet the turnover test, and are not a permanent employee of another employer.

Further details can be obtained from the Government’s Factsheet: Extension of the JobKeeper Payment.

For assistance with determining your eligibility for JobKeeper payments, registering for JobKeeper payments, our Audit Shield service, or if you would just like to know more, please contact us at consulting@austasiagroup.com.