Part 1: The Background

There is a lot of talk around Interest Rates in the media, on TV and everywhere at the moment. We have recently seen the Government announce that the consumer protection regulator, the Australian Competition and Consumer Commission (“ACCC”), will conduct an investigation of the banks and why they aren’t passing on interest rate cuts in full.

We are waiting now with great anticipation as the annual Melbourne Cup Reserve Bank Board Meeting will occur on the first Tuesday of November for ‘the race that stops the nation’. Usually, the interest rate decision is a blip on the day, as everyone is in the mood of the Spring Carnival Racing, and forgets about the interest rate decision until the hangover kicks in a few days later.

In getting ready for the interest rate decision and the race, we thought we would help with more information around what is happening now.

There are so many mixed messages coming from the media and Government, so, we thought it would be timely to decipher what is actually going on, and in our view, what the Government needs to be concentrating on to improve things economically.

Interest Rates in General

Interest rates are used as a way to either stimulate or taper down economic activity. Traditionally, it has been very effective, as economic theory of supply and demand has kicked in. That is, make things cheaper, and it will stimulate demand – lower interest rates mean more people wanting to borrow money.

This is why they are often used by Governments around the world to assist in stimulating economies and to fuel economic growth where needed.

In more recent times in various countries, including Japan and Europe, interest rate cuts have not worked, and so other measures have had to be considered.

Where are we Now?

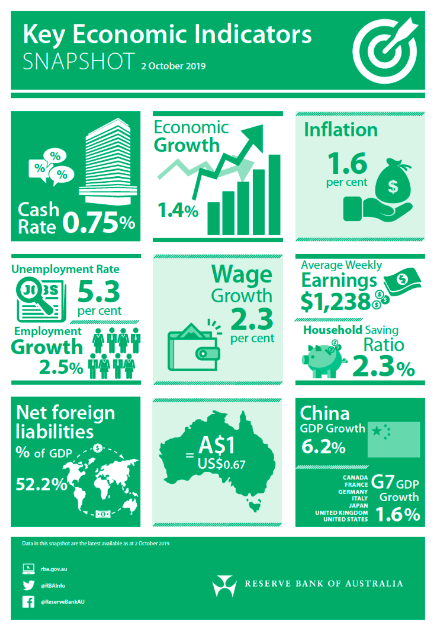

This is the current state of play provided by the Reserve Bank of Australia (“RBA”):

Put simply:

- Economic growth has slowed down to only 1.4%. Other countries around the world like the USA, UK and parts of Asia are forecasting over 3% in growth for the next 12 months. The G7 (which are the largest economies of the world – Germany, UK, USA to name a few) are forecasting 1.6% growth, and the Australian Economy is less than that.

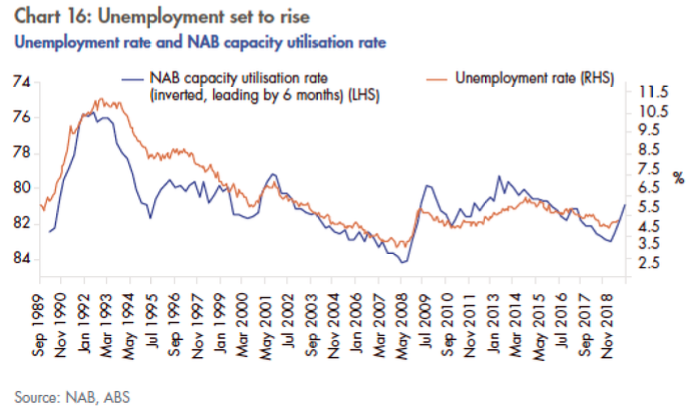

- The unemployment rate is growing and has increased to 5.3%. This includes employment of part-time and casual workers. This has steadily been increasing. To reduce unemployment, new jobs need to be created, which comes as a result of economic activity and growth.

- Our wage growth rate has just started to increase, which is now at a level higher than inflation. That means that if the wage growth rate continues and inflation keeps trending down, then unemployment is likely to increase, as jobs are made redundant due to increased price pressure.

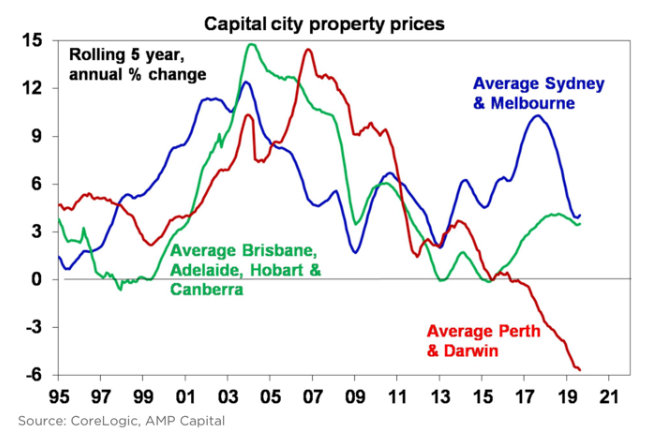

- The Property market may drop again. Unlike other states of Australia, WA has been in a flat property market since our last boom in 2006. While we have had a flat period since around 2010/11, other states have dropped more dramatically than what WA has in the last few months. The red line in the chart below is dragged down by Darwin, as Darwin has suffered from the Global Resource Crisis or Collapse (“GRC”) in 2015, which is why the red line looks a lot worse than what WA and Perth has encountered.

- The Australian Dollar has fallen against the USD, which is good on one hand with the cost of our exports cheaper for overseas customers, and also more tourists coming to visit Australia. But, as we import more products for day to day living, the inflation rate could increase.

- China’s growth rate has dropped down to 6.2%, which is still good compared to most other countries in the world, but it has dropped, which means less demand for our raw materials like iron ore and coal.

Important information and disclaimer

This publication has been prepared by AustAsia Group, including AustAsia Finance Brokers Pty Ltd (Australian Credit Licence No 385068), AustAsia Real Estate Pty Ltd (REBA Licence No. RA1736) and AustAsia Accounting Services Pty Ltd (Registered Tax Agent No 7587 3005).

AustAsia Accounting Services Pty Ltd – Liability limited by a scheme approved under Professional Standards Legislation.

Any advice in this publication is general only and has not been tailored to your circumstances. Accordingly, reliance should not be placed on the information contained in this document as the basis for making any financial investment, insurance, or other decision. Please seek personal advice before acting on this information.

Information in this publication is accurate as at the date of writing, 28 October 2019. Some of the information may have been provided to us by third parties. While it is believed the information is accurate and reliable, the accuracy of that information is not guaranteed in any way.

Opinions constitute our judgement at the time of issue and are subject to change. Neither the Licensee nor any member of AustAsia Group, nor their employees or directors give any warranty of accuracy, nor accept any responsibility, for any errors or omissions in this document.

Any general tax information provided in this publication is intended as a guide only and is based on our general understanding of taxation laws. It is not intended to be a substitute for specialised taxation advice or an assessment of your liabilities, obligations or claim entitlements that arise, or could arise, under taxation law, and we recommend you consult with a registered tax agent.