Part 2: The How’s, What’s and Why’s?

So, the RBA is concerned that the economy is on tenterhooks and could go one way or the other. Contrary to some commentators, the RBA generally won’t like to see a downturn or a recession – the same way that it doesn’t like to see a boom.

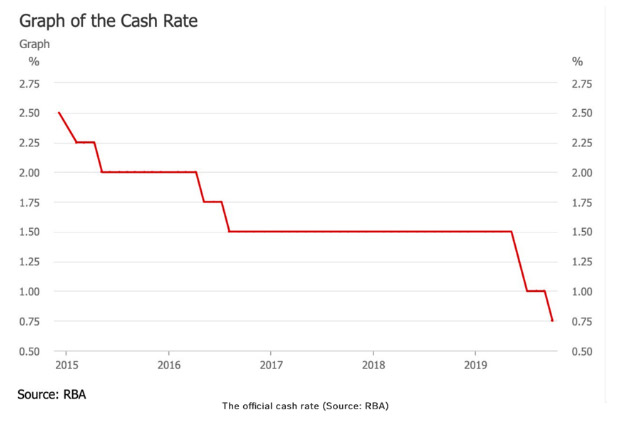

To help the economy from sliding into a downturn, and to improve its growth rate, the RBA has cut the official cash rate to 0.75%, and has given its strongest indication yet that it might go to 0%. Australia has never even been close to a 0% interest rate before. At the start of June, the official cash interest rate was 1.5%. This is what the interest rate chart over the last few years looks like:

Before this year (2019), the cash rate had never strayed below 1.5%, meaning the RBA is entering unchartered territory in doing so. The RBA Governor has signalled it doesn’t want to cut rates, but without the government increasing its spending it has no other choice to try to stimulate the economy:

“Quite simply, the economy requires more stimulus. Ideally, the federal government would rise to the occasion. Fiscal policy can be better targeted in the current environment and could stimulate the economy without pushing house prices and debt higher.”

It’s also worth noting that the Prime Minister Scott Morrison has indicated a willingness to look at budget stimulus at the mid-year budget review in December. Dropping interest rates can only do so much to stimulate the economy. So, it’s not a case of either stimulus or surplus.

What Should Interest Rates Do?

When interest rates are cut, in theory, money is cheaper. The banks are often expected – but not required – to pass on the changes to you, their customers. This affects you in two major ways:

- The lower the interest rate goes, the less interest you earn on your savings. Before the last cut, all the big four banks were already paying little interest on deposits at all. As more cuts are made, savings will struggle to grow at all. In fact, after you consider inflation, savings are far more likely to actually shrink in real terms as the cost of living rises. If a 0% interest rate is implemented, the bank is unlikely to pay you at all for having your money with them, leaving you with less incentive to save.

- The other big impact is on mortgages. As rates go lower, banks tend to slash their own rates. However, as the official rate nears zero it becomes less likely those cuts are passed on, even partially, because banks’ profit margins start to suffer. That was evident in the latest cut, with the big four only passing on around half of the cut.

How are Interest Rates that Financiers Charge Worked Out?

The lack of transparency and understanding on what drives interest rates is a major issue. Interest rates charged by banks are made up of a number of moving parts, which include:

- The source of their funds. Not all financiers have the billions of dollars that they want to lend out to the end investor. Some financiers raise monies from different sources, including but not limited to:

- Term Deposits

- Cash Management Accounts

- Superannuation Funds

- Overseas Pension Funds

- Overseas Banks

- If funds are sourced from overseas, exchange rates and then the length of time that they have the money from that source. For example, a fixed rate loan for 2 years may be funded by a source that only wants their money tied up for 2 years.

- APRA Regulatory requirements – the regulatory requirements for lending funds out now as issued by APRA stipulate that financiers need to have certain asset ratios for loans, depending on whether the loan is:

- Principal & interest

- Interest Only

- Owner Occupier (so you live in the property or the place that you are buying)

- Investment purpose

- Business loans – what is the purpose, and is it an overdraft or longer-term loan

- Security for business purpose loans – is it against a business, a commercial property, residential property, or no security

- Credit Cards

- Risk Grading – a number of financiers now have to review the risk grading of their loans to reflect the APRA requirements. There are a number of factors that are considered in risk grading, which include a number of the APRA requirements, but also other issues such as:

- Loan to value ratio (that is, how much is the loan as a percentage of the property or the value of the asset that is the security for the loan)

- Length of the loan (that is, how long is the loan)

- History of cashflow (that is, how long have you been employed, or how long has your business been in existence for)

- Payment Status (that is, are all of your loans, credit cards and tax obligations up to date)

- Payment History (that is, have you had any arrears or defaults in your loans before, or in your mobile phone, or rates and taxes and other obligations)

- ASIC regulation – this has been a very hot topic, as ASIC has been honing-in on the way that financiers have been lending money out. Depending on whether the loans are called Consumer Loans (so covered by the National Consumer Credit Protection Act 2009 – called NCCP), or not, also then dictates how much the financiers need to do in terms of assessment. ASIC regulates heavily in this area, so the cost of a financier or a broker or mobile lender to process a loan now involves more steps.

- International Regulatory Requirements – a number of requirements for international banking standards, such as BASEL III, have been adopted by APRA and other institutions to increase the requirements for banks and financiers to avoid another GFC from occurring.

It is little wonder that interest rates won’t always follow the RBA interest rates, due to the various factors that affect interest rates.

What Else is Going on?

As a result of the fallout of the GFC (yes, we are still dealing with those matters), and then the booming house prices from 2013/14 in Sydney and Melbourne (which were not experienced in Perth or Darwin), the then Government (which was a mix of Rudd/Gillard, and then Abbott/Turnbull) decided to win political points by leaving interest rates low, but getting the regulators to tighten-up things within the lending rules.

This was done so that interest rates didn’t need to be put up back in 2012/13 in order to win elections. In the background to cool off a heating market, the regulators went about making the banks increase rates by changing the rules.

Fast forward to today, and the Regulators now have more power than ever before. To provide some context, the major issue and concerns that we have with the two major regulators for banking, are:

- The Australian Prudential Regulatory Authority (APRA) has released a report which shows that its regulation of banks has helped to reign-in lending. They have published the great work that they have done by reducing the amount of monies that banks are lending out. See their report here for more information.

- The Australian Securities and Investments Commission (ASIC) – who recently sued Westpac for the way that they have dealt with the responsible lending provisions by banks to lend money to customers. The Federal Court ruled that Westpac had done nothing wrong, and that the ASIC had unrealistic expectations. ASIC has lodged an appeal against the decision. See this media release for more information.

Why Aren’t Rate Cuts Working?

The interest rate cuts have not worked, because the Government has a big roadblock sitting in the way. The roadblocks put up by APRA and ASIC, and the changing rules for borrowing money, have led to a lack of the ability to lend by financiers.

More lending and activity are required to stimulate the economy and the property market. The interest rate cuts have been ineffective, and only encouraged more saving and not spending, as borrowers are finding it difficult to lend money.

Our finance broking team, AustAsia Finance Brokers, has reported that approximately 50% of all of AAG clients who qualified for a loan 2 years ago would not qualify for a loan now.

A few recent examples have been property developers and builders – the banks see that as too high risk. Then, a lack of sales and ability for people to borrow means lower demand for property. A number of sales of properties of late have been people that have to sell due to financial stress. So, that only creates lower prices, which means a downward spiral effect.

For more information, check out this link.

Important information and disclaimer

This publication has been prepared by AustAsia Group, including AustAsia Finance Brokers Pty Ltd (Australian Credit Licence No 385068), AustAsia Real Estate Pty Ltd (REBA Licence No. RA1736) and AustAsia Accounting Services Pty Ltd (Registered Tax Agent No 7587 3005).

AustAsia Accounting Services Pty Ltd – Liability limited by a scheme approved under Professional Standards Legislation.

Any advice in this publication is general only and has not been tailored to your circumstances. Accordingly, reliance should not be placed on the information contained in this document as the basis for making any financial investment, insurance, or other decision. Please seek personal advice before acting on this information.

Information in this publication is accurate as at the date of writing, 28 October 2019. Some of the information may have been provided to us by third parties. While it is believed the information is accurate and reliable, the accuracy of that information is not guaranteed in any way.

Opinions constitute our judgement at the time of issue and are subject to change. Neither the Licensee nor any member of AustAsia Group, nor their employees or directors give any warranty of accuracy, nor accept any responsibility, for any errors or omissions in this document.

Any general tax information provided in this publication is intended as a guide only and is based on our general understanding of taxation laws. It is not intended to be a substitute for specialised taxation advice or an assessment of your liabilities, obligations or claim entitlements that arise, or could arise, under taxation law, and we recommend you consult with a registered tax agent.