Several clients have been asking us how they can invest in Socially Responsible investments (SRI).

In the past, SRI has been more closely aligned with diversity, inclusion, discrimination or oppressive companies (e.g. that have used slave labour) or environmentally friendly investments (such as tree farms, wind farms, solar etc.).

A new era of SRI is now upon us, with more and more companies looking for Net Zero carbon emissions as they move away from fossil fuels for energy to renewable energy.

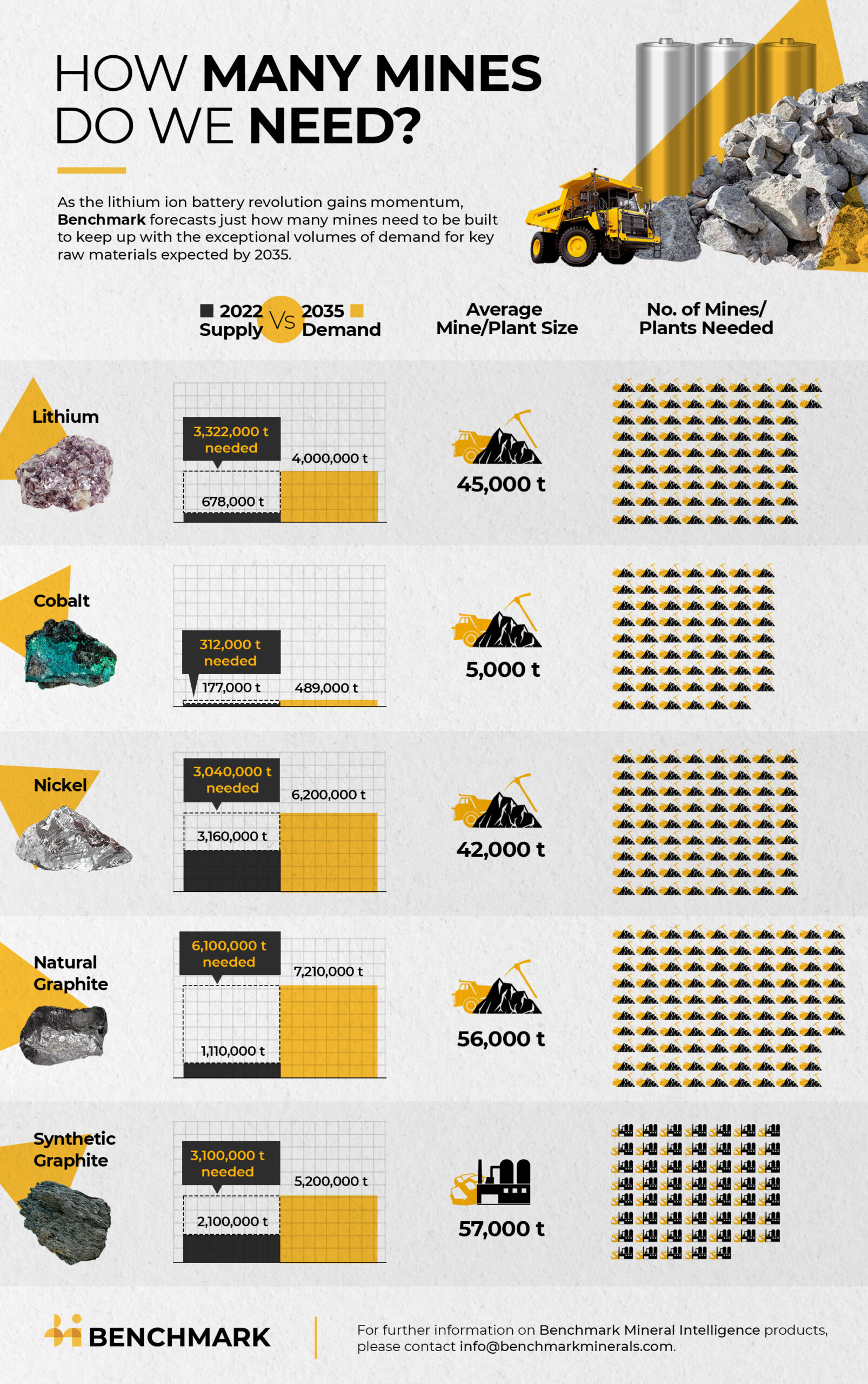

Now the focus is on investments in battery technologies or battery minerals/materials, which are involved in the decarbonisation of the world.

This diagram shows where the world is heading to hit Net Zero Emissions.

Many clients have been requesting how to get involved and to be able to invest in the future.

The concern is the high risk of mining companies for those in exploration or getting into production.

For every success story (like Pilbara Minerals), ten other companies are looking for the next significant discovery to move towards production – they may or may not get there.

We, therefore, have adopted the approach to consider Exchange Traded Funds which concentrate on a theme.

While the return may not be as high as a direct investment, the risk is also not as high as in stock picking and hoping that the correct result is found.

If you are interested in reviewing your portfolio or having a portion of your asset allocation into the new SRI or forward-facing metals, as they are sometimes called, please let us know how we can help you to incorporate this into your investment strategy.