You may have seen a lot of press lately surrounding Labor’s proposed polices targeting franking credit refunds, negative gearing and pension thresholds.

We just wanted to let you know that AAG are across these issues, including some rather creative solutions from financial journalists. In particular, there was an article in the West Australian recently about buying a Porsche, going on expensive holidays and other ways to blow your money to meet Centrelink Rules.

Let’s just start out by saying that if you blow your retirement cash to buy a Porsche, so that you can qualify for a Centrelink pension, you probably won’t be able to afford to service it or buy a new set of tyres. Or if you take a luxe holiday, you may not have any spending money.

Don’t make any decisions until you have all the facts. Let’s just wait and see what actually happens.

Just to refresh you, please click on these links for our take on the proposed changes – Part 2 directly addresses shares:

- Implications of Labor’s Proposed Policies: Property, Investment Property, Franking Credits and Other Issues – Part 1

- Implications of Labor’s Proposed Policies: Property, Investment Property, Negative Gearing, Franking Credits and Other Issues – Part 2

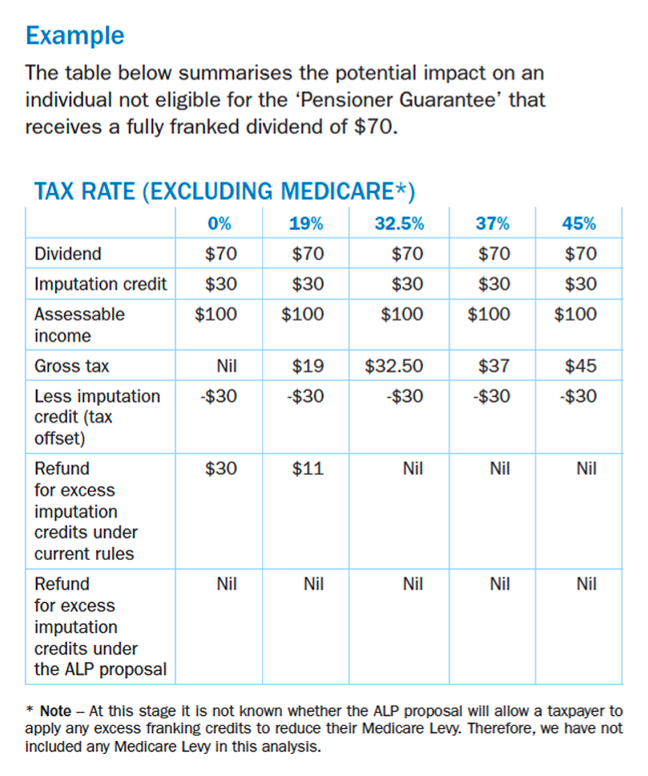

We have attached a Table extracted from a Colonial First State paper on franking credits. You will note that those in the 0%-20% tax brackets will be the hardest hit, while those with tax rates above 32.5% never received a refund anyway. For the full article, click on this link:

Labor Dividend Imputation Announcement

Please contact us if you are uncertain (or terrified) of what might lie down the track, that’s what we are here for.

We will adapt and carry on – just like we did last year, just like we will do next year.

Important information and disclaimer

This publication has been prepared by AustAsia Group, including AustAsia Financial Planning Pty Ltd AFSL License No 229454.

Any advice in this publication is of a general nature only and has not been tailored to your personal circumstances. Accordingly, reliance should not be placed on the information contained in this document as the basis for making any financial investment, insurance or other decision. Please seek personal advice prior to acting on this information.

Information in this publication is accurate as at the date of writing, 8 April 2019. Some of the information has been provided to us by third parties. Whilst it is believed the information is accurate and reliable, the accuracy of that information is not guaranteed in any way.

Opinions constitute our judgement at the time of issue and are subject to change. Neither the Licensee nor any member of AustAsia Group, nor their employees or directors give any warranty of accuracy, nor accept any responsibility, for any errors or omissions in this document.

Any general tax information provided in this publication is intended as a guide only and is based on our general understanding of taxation laws. It is not intended to be a substitute for specialised taxation advice or an assessment of your liabilities, obligations or claim entitlements that arise, or could arise, under taxation law, and we recommend you consult with a registered tax agent.