Why we still love dividends and you should too!

Australian companies pay out more of their earnings as dividends than overseas companies. That’s great for Australian shareholders, but some are arguing it’s a drag on the growth potential of the Australian economy; they say companies are paying out dividends rather than paying workers and investing in capital expenditure for the future.

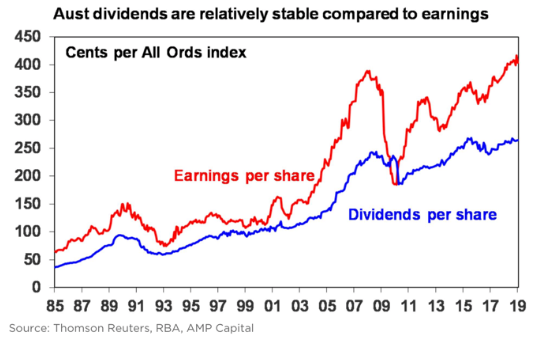

If you look at history, the dividend payout ratio now isn’t that out of whack with the historical average.

Dividend payments have risen a little recently because, unlike in the past, resources companies are now paying pretty decent dividends. It’s tough to argue they should be investing more in capital expenditure for the simple reason they have just had a capital expenditure boom.

There doesn’t seem to be any evidence that dividends are slowing down the rate of business investment in Australia.

According to Dr. Shane Oliver, Chief Economist at AMP Capital Markets, “businesses aren’t investing as much as we’d like because they are still cautious following the global financial crisis and following the surge in the Australian dollar, which made many of them uncompetitive a few years ago.”

Here are four more reasons why he thinks investors should like dividends, and we agree.

- Higher returns

Firstly, if you look at history, companies that pay out decent dividends tend to generate more profits and have higher returns. Why is that?Because they’re not wasting the money, often when companies retain their earnings or too much of their earnings, they lose it on projects that are nothing more than glorifying the CEO. Hubris takes over. So, it’s better to pay out those dividends.

- A bird in the hand

Historically, roughly half the returns from Australian shares come from dividends – it’s like a down payment on your total return: you’re not relying on capital gains as much because you have already got a ‘bird in the hand’ from dividends. - A vote of confidence

Thirdly, the fact that companies are paying decent dividends gives us a bit of confidence that their earnings are real, and that the company has faith in the future. - A great source of income

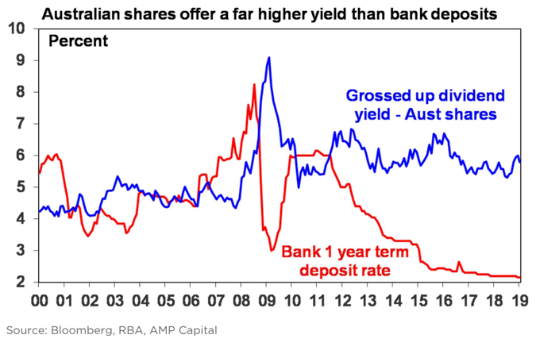

Finally, and this is significant for investors; dividends provide a good source of income.The dividend yield on the Aussie share market is around 4.5%. With franking credits added in, that pushes up to approximately 5.5-6%.That makes the share market quite attractive at a time when the cash rate in Australia is 1% and likely to fall further.So, term deposit rates currently around 2%, are also expected to fall further.This is one of the primary reasons we like to buy the bank stocks, rather than give them our money for inferior Term Deposit rates. If you think they’re good enough to honour your Term Deposit, unquestionably you must believe in their business.

Governments can’t mess with our dividend system

Given these benefits, it’s essential that governments don’t mess with our dividend imputation system, because it helps reinforce the payment of dividends in Australia.

Our dividend system also corrects a massive distortion that would otherwise occur – and did exist before the 1980s – where company earnings are taxed twice, once in the hands of the company as company profits, and again in the hands of the shareholder as income from dividends.

Make dividends a focus

So, the bottom line is, Dr. Shane Oliver thinks dividends are great, and so do we. One of the things that always excites us about the Australian share market is the decent amount of dividends that are paid by Australian companies.

But, you must have a portfolio of shares. Don’t just rely on one or two companies because you never know – the company you invest in may not pay that dividend indefinitely; they might cut it.

But when thinking about investing, make sure you do focus on dividends because they are significant and they do give confidence about the future; and in Australia, at least, they provide a pretty good yield.

In writing this report, we have sourced information from the following providers, including but not limited to:

Aberdeen Standard Investments, AMP Capital Markets (including Dr Shane Oliver, Chief Economist and Head of Investment Strategy), ANZ Capital Markets, Australian Bureau of Statistics, BetaShares, Bloomberg, Business Insider, Colonial First State, Commonwealth Bank, Investopedia IRESS, Investopedia Livewire Market Watch, Investopedia Macquarie, Morningstar, Montgomery Investment Management, Peter Switzer, Reserve Bank of Australia, Russell Investments and VanEck.

Important information and disclaimer

This publication has been prepared by AustAsia Group, including AustAsia Financial Planning Pty Ltd (AFSL License No 229454) and AustAsia Accounting Services Pty Ltd (Registered Tax Agent No 7587 3005).

AustAsia Accounting Services Pty Ltd – Liability limited by a scheme approved under Professional Standards Legislation.

Any advice in this publication is general only and has not been tailored to your circumstances. Accordingly, reliance should not be placed on the information contained in this document as the basis for making any financial investment, insurance, or other decision. Please seek personal advice before acting on this information.

Information in this publication is accurate as at the date of writing, 10 July 2019. Some of the information may have been provided to us by third parties. While it is believed the information is accurate and reliable, the accuracy of that information is not guaranteed in any way.

Opinions constitute our judgement at the time of issue and are subject to change. Neither the Licensee nor any member of AustAsia Group, nor their employees or directors give any warranty of accuracy, nor accept any responsibility, for any errors or omissions in this document.

Any general tax information provided in this publication is intended as a guide only and is based on our general understanding of taxation laws. It is not intended to be a substitute for specialised taxation advice or an assessment of your liabilities, obligations or claim entitlements that arise, or could arise, under taxation law, and we recommend you consult with a registered tax agent.