Wars are devastating for all those involved and the human race in general. Unfortunately, wars are part of our global landscape.

Here, we try to focus on the economic and market impacts, most notably, the price of oil.

Key points

- The war in Israel has added to the upside risks to increases in oil prices and downside risks to shares dropping in the near term.

- If Iran stays out of the conflict and a significant supply disruption is avoided, the impact on shares should ultimately be minimal.

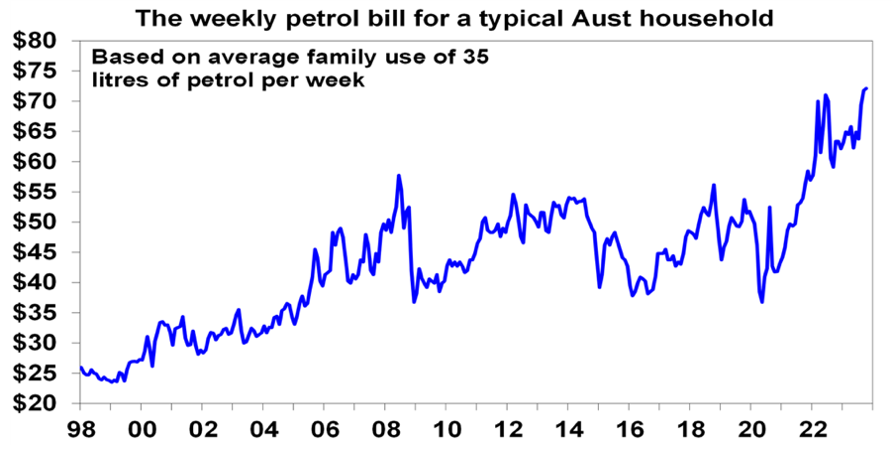

- The rise in petrol prices has already added $12 a week to Australia’s average household fuel bill since May 2023 (less than 6 months ago).

The oil price

Oil prices were already up.

It comes at a time when oil prices had already reversed a large part of their fall into June to just below $US70 a barrel after their rise last year to a high of $US123 on the back of the invasion of Ukraine, which was their highest since 2008 when they peaked.

Oil prices and conflicts in Israel and the Middle East

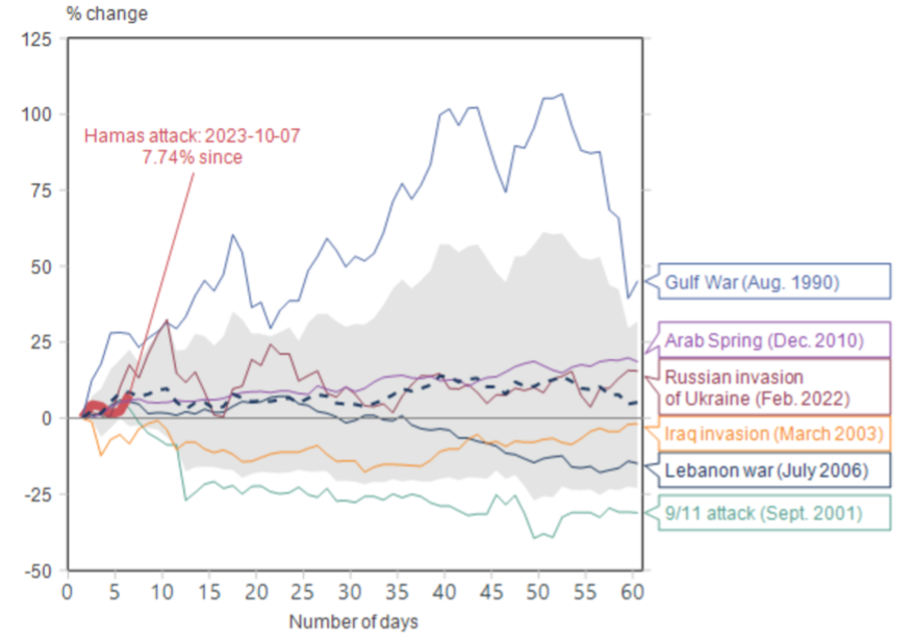

Since Hamas’ attacks, share markets are slightly up and the oil price is up $US4/barrel.

So why aren’t markets more concerned?

Surely any conflict in the Middle East is bad via higher oil prices?

Well, not necessarily – as it depends on whether global oil supplies are significantly impacted or not:

The first global oil shock in 1973 came with the Arab/Israeli war that saw many Arab countries against Israel and saw OPEC boycott oil supplies to the US which drove a fourfold increase in world oil prices.

The second oil shock in 1979 came as the Iranian revolution saw its oil production collapse and resulted in a threefold increase in oil prices.

Since then its been more mixed:

- the first Gulf War in 1990-91 (which saw Iraq invade Kuwait and a coalition led by the US dislodge it) saw a spike in oil prices but it was brief;

- the second Gulf War in 2003 (which saw the invasion of Iraq) had little impact; and

- the war in Lebanon (2006), Arab Spring (from December 2010), war in Syria and numerous flare ups in the Israeli/Palestinian conflict have had little impact.

Oil prices and various geopolitical events since 1990

The key is whether oil supplies from major producers in the Middle East are impacted.

Israel along with Lebanon and Syria are not big oil producers.

And this is not a re-run of the 1973 conflict – now Arab countries are on the sidelines with many having better relations with Israel.

In fact, the timing of Hamas’ actions looks motivated to prevent progress towards a Saudi/Israeli security pact which could have further isolated them and Iran.

Just for some background, many of you would have heard of OPEC. OPEC stands for “Organization of the Petroleum Exporting Countries.” OPEC accounts for approx. 30% to 35% of the world supply of oil, and the member countries are predominantly Middle East and African nations, being as follows:

- Iran

- Iraq

- Kuwait

- Saudi Arabia

- UAE

- Libya

- Nigeria

- Algeria

- Angola

- Congo

- Equatorial Guinea

- Gabon

- Venezuela

Then there is OPEC+, which are not actual member states, but they observe the production cuts from time to time, which includes Russia and Oman (Middle East).

The main risk is if Iran, which backs Hamas and Hezbollah in Lebanon, is drawn into the war which could threaten its oil production (2.5% of global consumption), the flow of oil through the Strait of Hormuz (through which 20% of world oil flows) or even Saudi production (as Iran did in 2019).

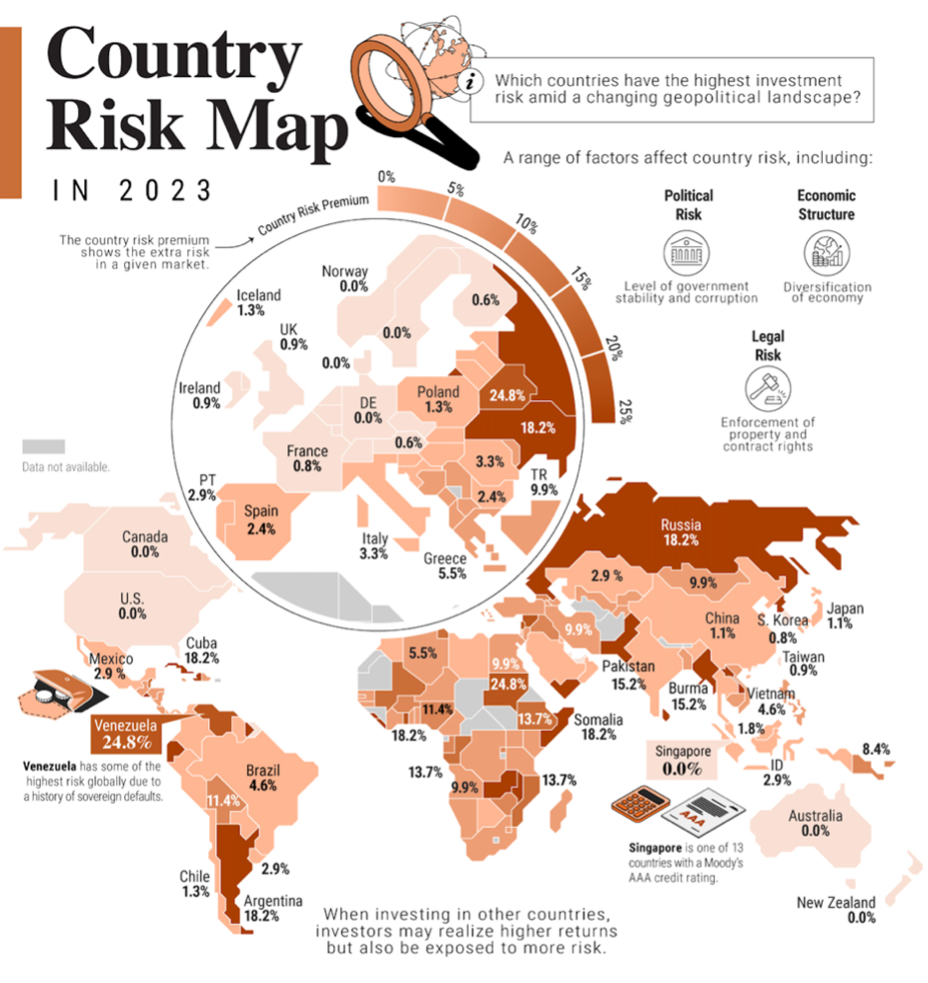

Country Risk Map

As promised, here is the Country Risk Map which uses the following parameters in assessing risk:

- Political Risk

- Economic Structure

- Legal Risk

Outside of war zones, Africa is becoming more un-investible by the day through a combination of political unrest and uncertain ownership and tax structures.

Despite the red tape and an unsupportive government Australia remains top of the tree.

Well done us!

In conclusion

The war in Israel has added to the upside risks to oil prices and downside risks to shares in the near term.

If Iran stays out of the conflict and a major supply disruption is avoided, the impact on shares on a 12-month view should be minimal.

Global markets have not been overly concerned by the war in Israel with US and Australian shares up over the last week.

So far investment markets appear to have concluded that Iran will not become involved, with oil prices up but still down from recent highs, and that the conflict will be limited to Israel with little impact on oil supply.

If that remains the case, then expect minimal impact.

If not, then expect a surge in oil prices.

We’re here to help

Don’t panic! For all of your investment and financial planning needs, contact us today.