Amidst a challenging economic climate characterized by rising interest rates and living expenses, Australian Treasurer Jim Chalmers has unveiled the 2023-24 Federal Budget. The budget includes several proposals aimed at easing the financial burden on Australians, encompassing energy bill rebates, assistance with out-of-pocket healthcare expenses, and increased financial support for jobseekers and renters. It is important to note that these proposals are subject to potential changes as they navigate the legislative process in parliament. It is only after receiving formal acceptance from the Governor-General, known as Royal Assent, that legislation passed by the Australian Parliament becomes law.

Key Economic Indicators 4 May 2023

Not Life-Changing

The Government has announced a range of items, which in our view are not life-changing. Many clients have concerns about how the Government announcements and policies will affect them and their day-to-day lives (interest rates, taxes etc.). Some clients want to know more about how the budget (and economic issues) may affect them.

So we have summarised our analysis into the following main areas, and you can click the Read More button within each section for more details:

Individuals and families

The Australian government has announced several measures to increase support for low-income households and families.

From September 20, 2023, working-age and student payments will increase by $40 per fortnight, while the maximum rate of Rent Assistance will increase by 15%.

Eligible single parents will also receive Parenting Payment (single) until their youngest child turns 14, and households and small businesses will receive rebates on their power bills.

Additionally, the government will invest $3.5 billion over five years to triple the bulk billing incentive for GP consultations for children under 16 and Commonwealth concession card holders, enabling 11.6 million eligible Australians to access a doctor with no out-of-pocket costs.

Small Business

A new instant asset write-off to $20,000 from 1 July 2023 to 20 June 2024

The Government will improve cash flow for small businesses by providing an instant asset write-off threshold of $20,000 for businesses with an aggregated annual turnover of less than $10 million.

An extra tax deduction for assets that are “Energy Efficient” for businesses with less than $50m turnover, and up to $100k asset purchase.

The amount of the additional tax deduction is 20% of the cost (net of GST).

Aged Care

Reforming aged care over the next five years, from 2022 to 23.

The Government is providing extra funding to:

- increase the pay of many aged care workers by 15%

- provide an additional 9,500 Home Care packages

- continue COVID-19 measures

- strengthen regulation

Postpone the new ‘Support at Home Program’ and extend grant arrangements for the ‘Commonwealth Home support Programme’ for 12 months.

Superannuation

Starting from July 1, 2026, employers in Australia will be required to make superannuation contributions on the same day they pay their employees’ salaries instead of the current quarterly contributions.

The government estimates that a 25-year-old worker earning the median wage would see their retirement savings increase by $6,000 due to this reform.

Additionally, starting from July 1, 2025, the government is implementing a higher tax rate on earnings from superannuation balances exceeding $3 million.

The headline tax rate for these high balances will be increased from 15% to 30%. However, this higher tax rate will only apply to earnings corresponding to the proportion of a person’s superannuation balance that exceeds $3 million.

Housing Affordability

Commencing on July 1, 2023, the Australian Government is expanding the Home Guarantee Scheme to promote greater participation among first-home buyers.

The expansion includes allowing siblings, friends, and other family members to utilize the Government’s first home buyer programs together by becoming joint applicants for a guarantee.

This extended eligibility applies to programs such as the First Home Guarantee, the Regional First Home Guarantee, and the Family Home Guarantee.

Moreover, the scheme will now be accessible to individuals who have not owned a house within the previous ten years, further broadening the program’s reach.

Medicare Levy

Low-income thresholds will increase slightly effective 1 July 2022, meaning low-income taxpayers will continue to be exempt.

- Singles will be increased from $23,365 to $24,276

- Families will be increased from $39,402 to $40,939

- Single seniors and pensioners will be increased from $36,925 to $38,365

- Families (seniors and pensioners) will be increased from $51,401 to $53,406.

The family income thresholds for each dependent child or student increases by $3,760.

Tax Rates

No changes to incoming tax rates for 1 July 2024

| Marginal tax rate* (%) | Thresholds – income range 2022-23 to 2023- 24 ($) | Marginal tax rate* (%) | Thresholds – MTR* (%) and income range from 2024-25 ($) |

| 0 | 0 – 18,200 | 0 | 0 – 18,200 |

| 19 | 18,201 – 45,000 | 19 | 18,201 – 45,000 |

| 32.5 | 45,001 – 120,000 | 30 | 45,001 – 200,000 |

| 37 | 120,001 – 180,000 | – | |

| 45 | > 180,000 | 45 | > 200,000 |

| Low income tax offset (LITO) | Up to 700 | LITO | Up to 700 |

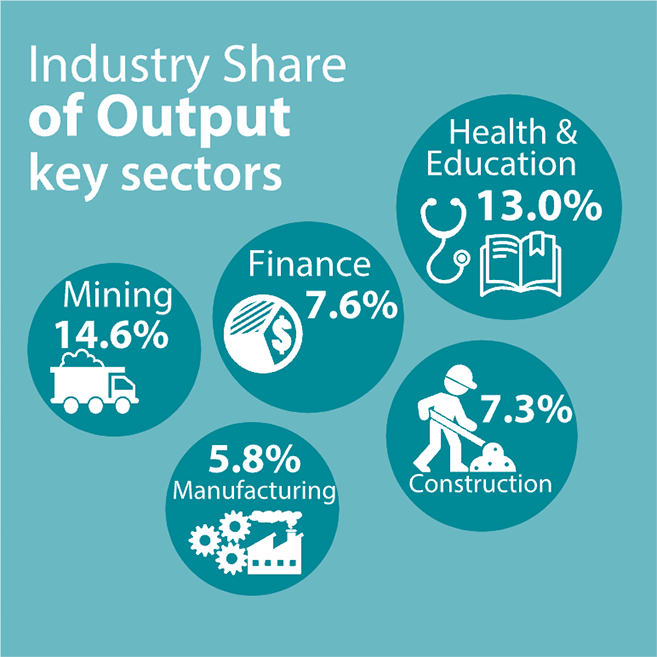

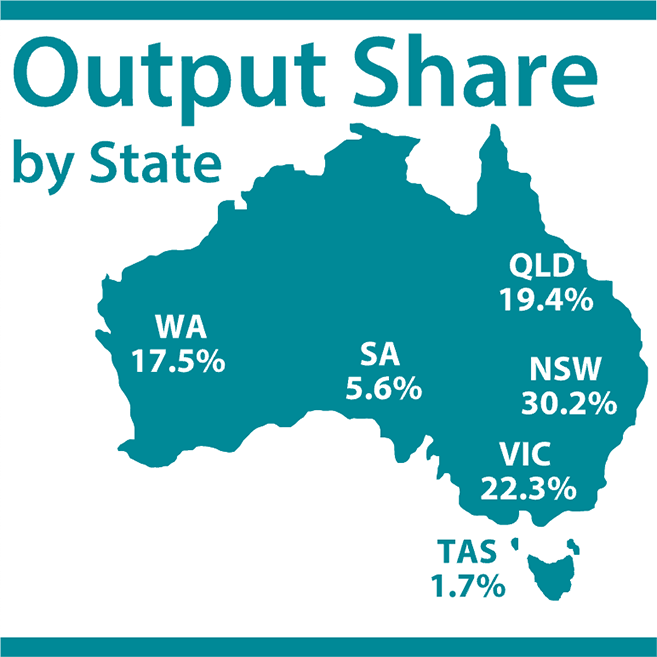

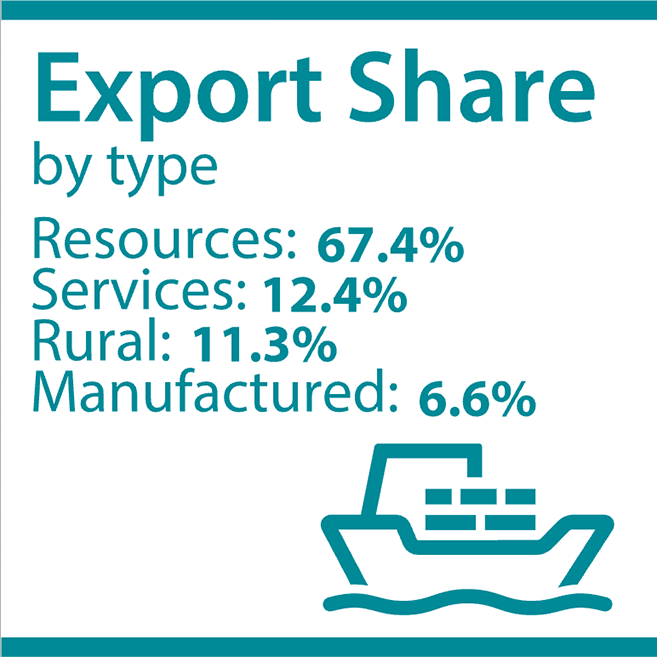

Composition of the Australian Economy

How Australians Pay (2019 survey)