On 25 March 2025, the Federal Government presented its 2025-26 Federal Budget, with personal income tax cuts providing the big moment.

Income tax cuts are a dazzling headline, but in reality, they deliver a tax saving of up to $268 in the 2026-27 year, with a tax saving of up to $536 from the 2027-28 year.

Two previously announced measures of note that have not passed Parliament but remain in the Budget are:

- Tax on super accounts above $3m (a 30% tax on future earnings for superannuation balances above $3 million); and

- The $20,000 instant asset write-off for small businesses for 2024-25.

Both of these measures have stalled in Parliament and, assuming they are not approved in the final days of Parliament, will lapse when an election is called.

Budget 2025-26 is a budget for voter appeal with over $7bn in additional spending measures in 2025-26 and over $20bn across five years.

The Australian Taxation Office has been allocated almost $1 billion in funding to extend and enhance its compliance programs.

Most measures extend previously announced and budgeted items for another year.

Key initiatives include:

Energy

- $180 billion to deliver a $150 energy bill rebate extension until the end of 2025.

Healthcare

- $1.8 billion over 5 years for cheaper medicines on the Pharmaceutical Benefits Scheme.

- $240 million for women’s health – reproductive health and menopause

- $8.5 billion on Medicare for increases to Medicare payments, 50 new urgent care clinics, and a bulk-billed GP service.

Education

- $500 million to provide a 20% cut to HECS-HELP debt for students and a realignment of the repayment schedule to reduce the amount required to be paid (from 1 July 2025).

Housing

- $800 million to expand the ‘Help to Buy’ scheme, reducing the size of the deposit required to buy a home by co-buying with the Government.

Families

- Three days of subsidised childcare for families with young children (income tested) from 1 January 2026 replacing the Child Care Subsidy activity test.

Lifestyle

- From August, the excise on beer will be frozen for 2 years.

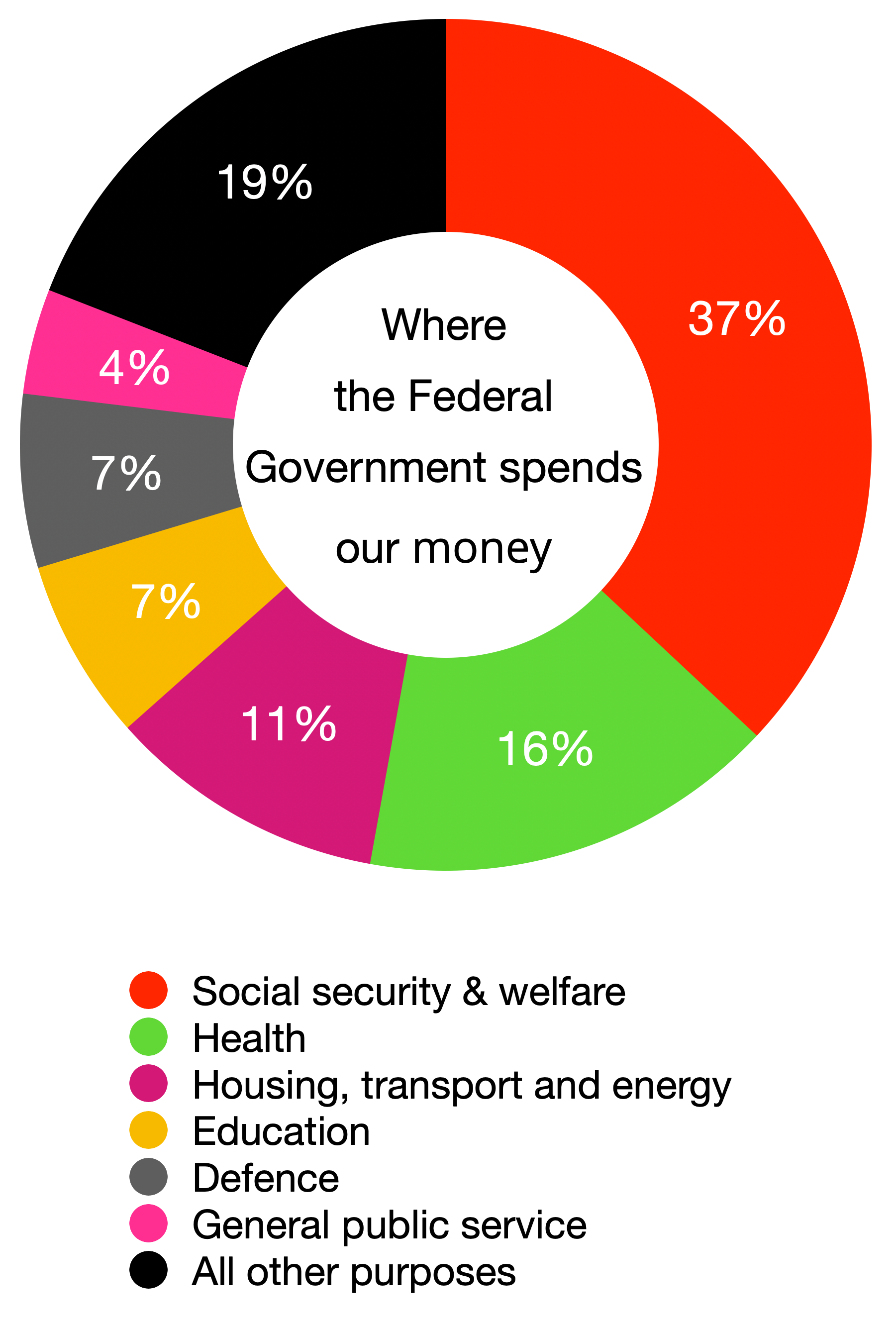

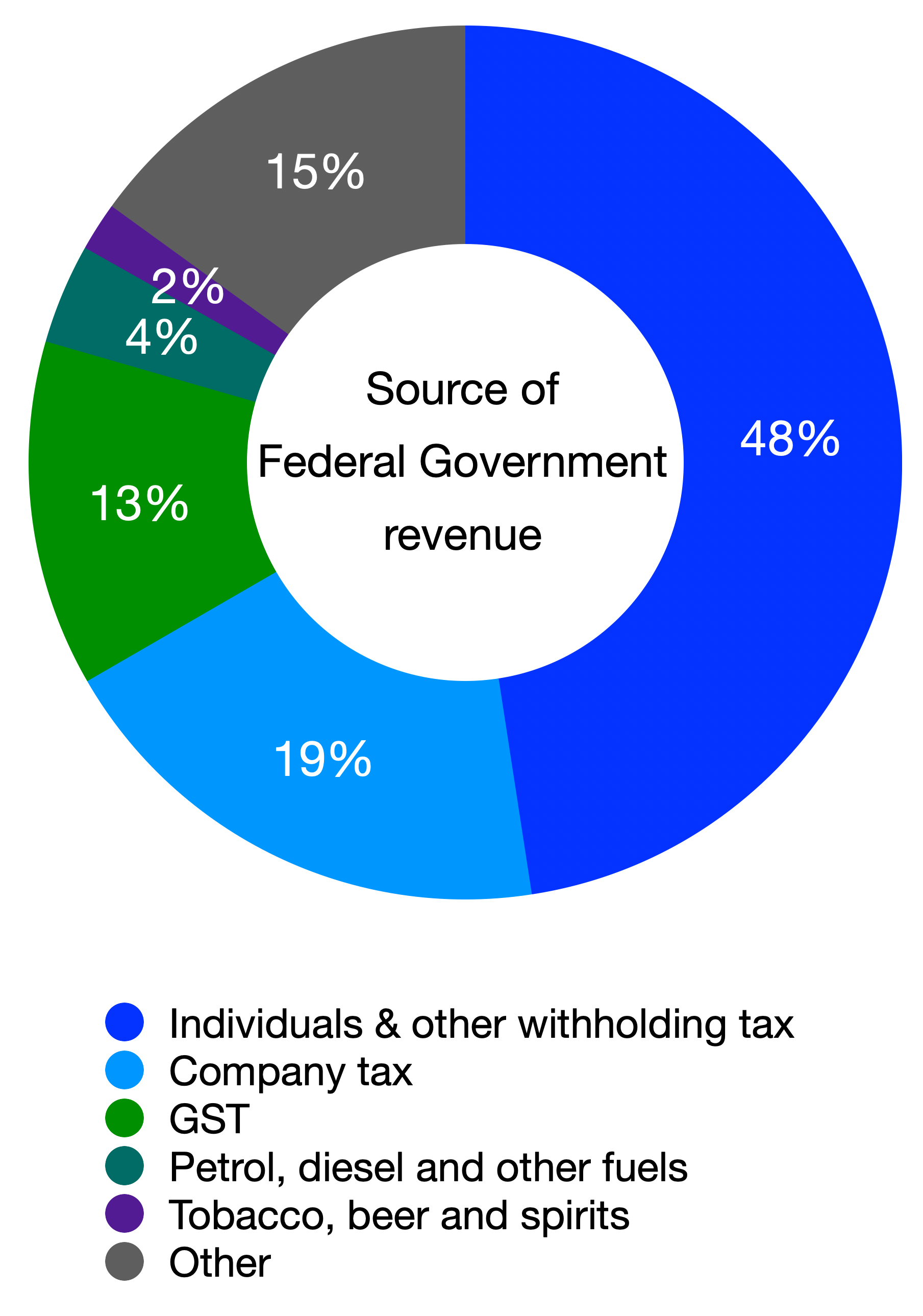

All figures are estimates. Source: Treasury 2025-26

The Economy

Economically, trade tensions have magnified global uncertainty. Global growth is already subdued. The indirect effect of tariffs is estimated to be nearly four times as large as the direct effect on Australia, reflecting the relative importance of affected trade flows between Australia, China, and the United States.

Australia’s economy is expected to grow, albeit slowly, at 2.25% in 2025-26 and 2.5% in 2026-27.

The Budget will be in deficit at -$42.1 billion in 2025-26, before improving marginally but remaining in the red.

For more details, download this PDF file.