Just in case you haven’t heard, Donald Trump has been elected for another four-year term as POTUS, commencing 20 January 2025.

Whatever you may think of Trump, it was a Masterclass in political strategy.

But what does that mean for Australian & global markets?

It’s worth noting that while the US Presidential election is important,

many other things impact investment markets & investors should

remain focused on long-term investing.

For now, we continue to see central banks cutting interest rates

as inflation falls, which will help share markets.

But that’s boring… let’s look at what might play out.

We’ll start with the Key Points for those who just want a quick

run-down (& may drift off), then go into detail later.

Key Points

- The return of Donald Trump to the US presidency brings the prospect of more US tax cuts & deregulation but also more tariff hikes, trade wars & policy uncertainty.

- His win was not the surprise it was in 2016, & markets have moved to adjust – but it means higher US bond yields (as interest rates won’t fall as quickly), a higher $US & a knee-jerk rise in shares.

- Shares could be threatened, though, by the higher bond yields & tariffs.

- Australia is vulnerable to an intensification of trade wars.

- While the US election is important, investors should bear in mind that many other things influence investment markets.

Trump’s key policies

- Less tax.

- Trade & imposing tariffs.

- Crackdown on immigration.

- Roll back Fed independence (The Fed, that is, which is the US equivalent of our RBA).

- Climate policy wind back.

- Less regulation & slashing energy & financial regulation – you’ve heard the term “drill baby drill”? More on what we expect to happen to energy prices further down.

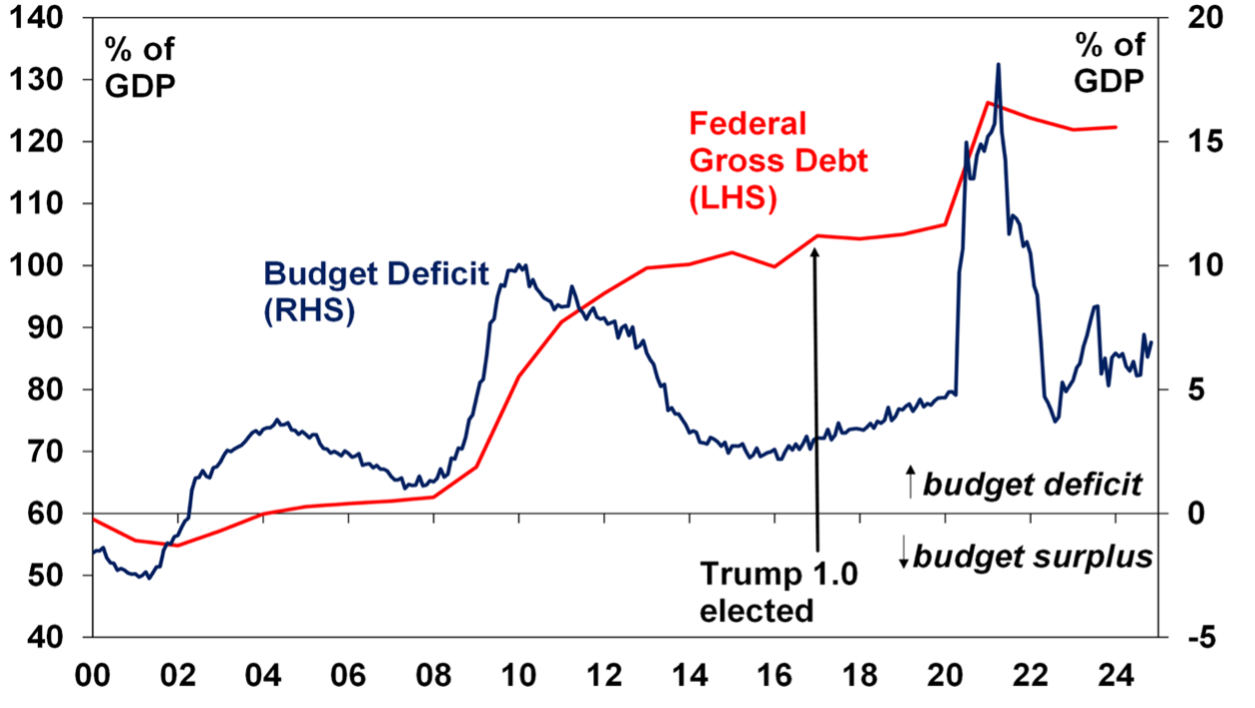

- Higher budget deficits.

Key implications, risks & uncertainties

- There will be less checks & balances this time around.

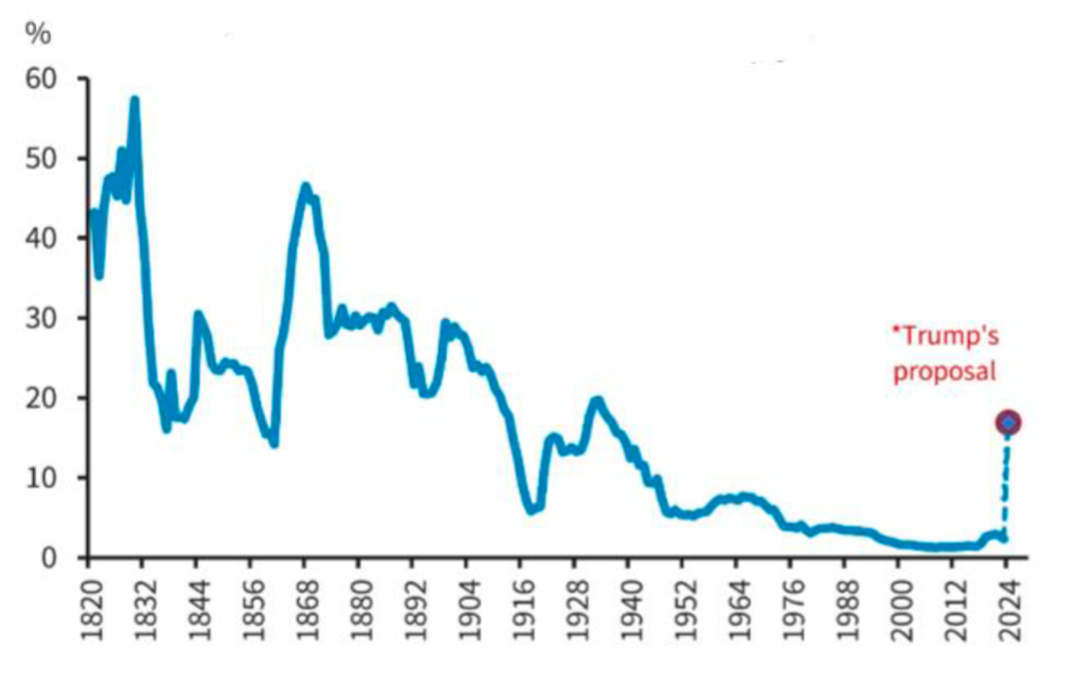

- Expect another ramp-up in trade wars & further deglobalisation.

- Expect more policy uncertainty.

- Increased global uncertainty.

- Finally, the policies may have a short-term impact on investment markets but are expected to be more sensible in the longer term.

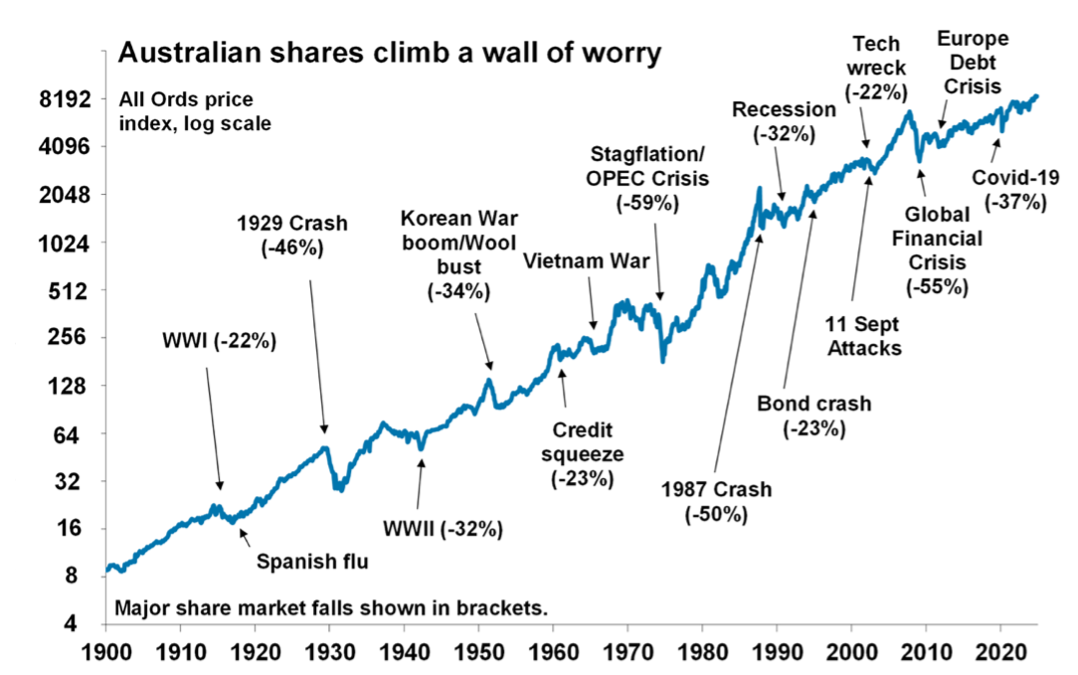

Remember the Wall of Worry… we always overcome it!

Source: ASX, AMP

Likely market implications

Trump’s policies point to:

- Upward pressure on US bond yields – via a bigger budget deficit & higher inflation & less rate cuts from the Fed.

- Upward pressure on the $US – via higher tariffs, higher than otherwise Fed interest rates & increased global uncertainty.

- Upward pressure on Bitcoin & other cryptos as Trump is seen as more favourable towards crypto.

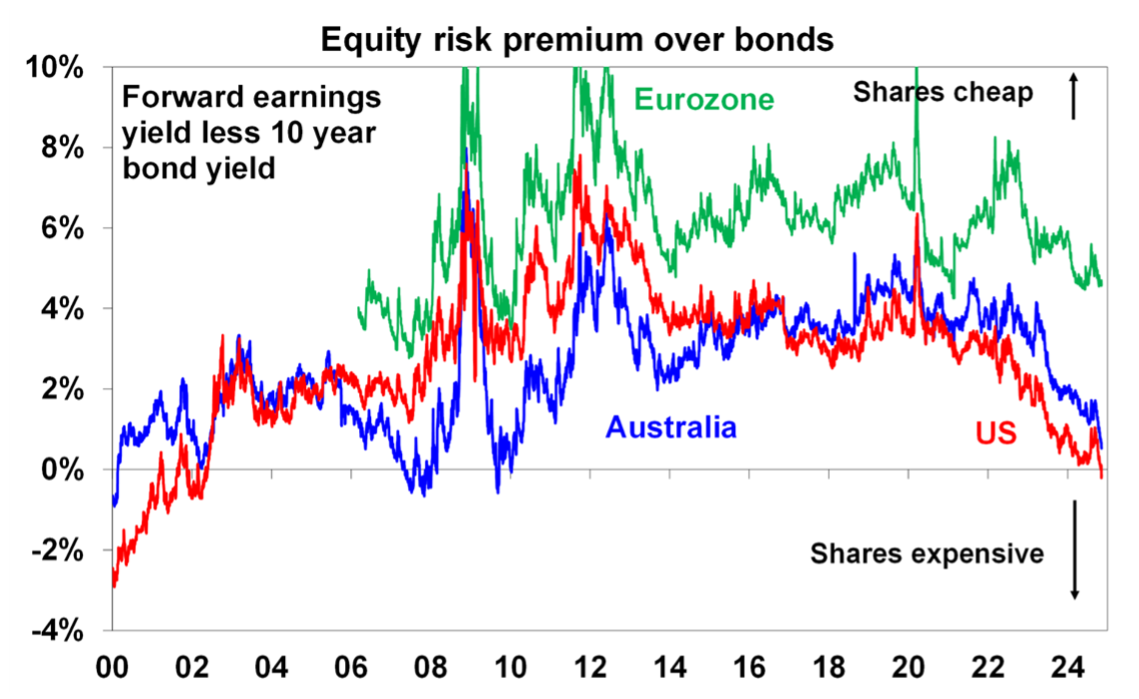

It’s likely that crypto markets have further to go in the short term, but this win for Trump is very different to 2016, where his win surprised markets, resulting in big market moves. - Ambiguity for the US share market with tax cuts & deregulation being positive (driving a short-term boost), but trade wars & higher bond yields being negative (on a cyclical view).

At the time of Trump’s victory in 2016, shares were relatively undervalued & soared 38% into January 2018 as the focus in his first year was on business-friendly tax cuts & deregulation, but they fell in 2018 as the focus shifted to trade wars.

This time around, shares are already expensive, so the upside may be more limited.

That said, shares may still see further post-election gains on relief that it’s out of the way & hope that he focuses more on tax cuts & deregulation, but this could be reversed if he starts focussing on tariffs & as higher bond yields are bad news for shares. - Upward pressure on US financial & energy shares (less regulation) relative to clean energy shares (as climate measures are reversed).

Source: Bloomberg, AMP

How will it effect Australia?

Australians have reason to be concerned as we are vulnerable to a new Trump trade war!

Exports to the US are only 4% of Australia’s total exports & may be spared from Trump’s tariffs as Australia has a trade deficit with the US.

But, as an open economy with high trade exposure to China, Australia is vulnerable to global trade wars, particularly as it weighs on demand for Chinese exports.

An OECD study showed that Australia could suffer a 1.2% reduction in GDP as a result of a 10% reduction in global trade between major countries.

Resources shares would be most at risk & the $A would likely fall (and we have already seen a bit of that). More on the energy sector later.

Of course, similar fears existed during the last Trump trade war, & it didn’t turn out so bad (although the $A fell 10% in 2018 with US tariff hikes & Fed rate hikes).

And there would still be demand for iron ore somewhere – it just may switch from China to elsewhere.

Much will depend on how other countries respond & how hard Trump goes.

There is also the risk that if Trump’s policies boost US inflation there could be a global flow on, including to Australia, resulting in higher than otherwise RBA interest rates.

This is a risk, but we suspect it would be offset by the growth dampening impact of an intensified global trade war.

From a policy point of view, if Trump cuts the US corporate tax rate to 15% on domestic profits it could renew pressure on Australia to cut its corporate tax rate.

Trump’s reversal of US climate policies will again add to confusion & may increase pressure for Australia to slow its net zero commitment.

Anecdotally, a recent survey found that 30% of Australians would have voted for Trump.

Final thought before we delve deeper

So far, equity markets have focused on the positives, helped by the fact the Fed is still talking rate cuts despite the potential upward pressure on inflation from Trump’s trade & tax policies.

Here comes the detail

Donald Trump delivered a resounding victory, sweeping the battleground states & winning the popular vote in a stunning political comeback that promises to reshape the US economy for decades to come.

What is the Red Wave?

The Republicans control both the upper & lower houses of government, which is called the Red Wave.

He only has four years, so we expect an aggressive & decisive presidency, with swift & sweeping changes to the way the US does business.

US citizens may not have known what they would get in his first term, but they certainly knew what they would get in a second term & that’s the way they voted.

The breadth of Executive Orders has never been fully tested.

He will try to push through his agenda, so we expect many curve balls.

While immediate inflation risks seem manageable, Trump’s likely extension of tax cuts, coupled with the prospect of tariff measures, raises a clear risk of resurgent domestic inflationary pressures.

Wave of deregulation

US policy changes will unlock a global wave of deregulation.

Deregulation in one market eventually will bleed into the rest of the world.

Banking could be the first industry to benefit.

Let’s hope we’ve learned our lessons from the Global Financial Crisis, though….

US energy independence

Another important shift will be the new US intention to achieve “oil independence” which has the potential to provide a competitive advantage to American industry & allow for a re-industrialisation of the US economy.

The US holds major reserves of oil & gas.

They’re going for a system of energy which is self-dependent & low cost, which allows them to invest in other industrial assets & petrochemicals.

Lowering the cost of energy could offset inflationary pressures from tariffs.

But it’s not as simple as drill baby drill (the slogan that his campaign borrowed from former Alaskan governor Sarah Palin).

Flooding the global economy with cheap energy offers an inflation-busting strategy (greater supply of oil & gas).

But new supply can’t be turned on with the flick of a switch.

Whether it’s a new mine or an O&G field, finding, developing, & activating a new operation takes years. Often more than a decade.

Even if you know where it is & have commenced developing it, it still takes years before oil or gas flow through the pipe to industry & consumers.

And new sources are becoming harder to find.

They’re also getting deeper, more difficult, & more expensive to develop!

Add to this that there has been years of underinvestment in exploration.

The shift to energy independence will also likely lead to a recalibration of the previous administration’s emphasis on climate change & environmental issues & dampen enthusiasm for electric vehicles.

This means there could be less demand for the minerals associated with clean energy technologies which will have implications for Australia.

But we still think the best energy investment out there is Woodside. Gas remains a solid investment theme, here’s why.

The Political Masterclass

The thought that there might be more “shy Harris” supporters this time around proved horribly misplaced – moderate Republicans did not flip.

Instead, there appeared once again to be more “shy Trump” supporters (or, at least, pollsters did not survey enough of them), especially among a wide range of younger, non-white & non-college-educated voters.

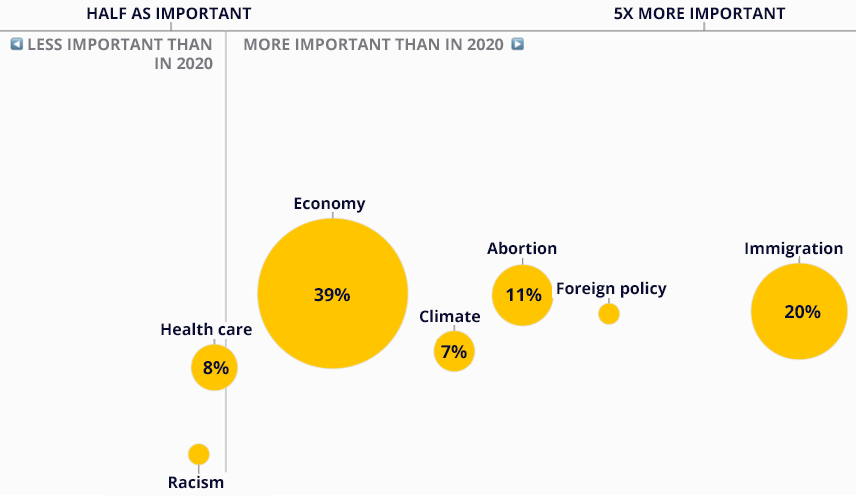

Simply put, Trump campaigned on what swing voters most cared about – the economy & immigration, rather than the issues of democracy & reproductive rights.

It was a masterclass in political strategy from Trump – &, in hindsight, Harris/Biden either had to fight & win on the economy or concede & let a new face fight that fight without their legacy.

Policies that require Congressional approval

- Fiscal policy requires congressional approval, i.e. government spending & tax

However, with a Republican sweep, Trump will largely have an unfiltered ability to enact fiscal policy as he sees fit.

Expectations are that the tax cuts passed in 2017, due to expire at the end of 2025, will be extended.

Broad tax cuts, including corporate tax, are likely to increase the budget deficit; however, this will be partially offset by the revenue raised from increased tariffs.

Elon Musk will co-lead a new agency to bring efficiencies in government & has proposed cutting spending materially, but this is going to be tough as cutting spending can be kryptonite.

Fiscal deficits, which are already wide, are likely to get wider over the next few years.

So, tax cuts are likely to be modest, although there is a potential upside to tax revenue if AI boosts GDP materially. - Trump has also expressed a desire to repeal parts of Biden’s Inflation Reduction Act (IRA).

However, Republican states have been big beneficiaries of the spending from the IRA, so policy changes around it are expected to be marginal. - Trump has also promised to slash regulation, which is likely with the Republicans controlling the House & the Senate.

No Congressional approval required

- Trump has broad authority to impose tariffs, although this needs to go through a lengthy process, which means the time between decision & implementation can be prolonged.

He has already announced some tariffs (that are far greater than his first presidency) & negotiate a “better deal”.

The “better deal” may result in some of the tariffs not being applied depending on what he can negotiate. He certainly has started the negotiation process with some rather brutal tariffs, especially on China.

But the $US will strengthen further on tariffs, especially against the Chinese Renminbi, which may be devalued by 20-30% vs the $US if 60% tariffs are applied.

For China, a Trump administration is bearish for exports to the US & inbound investment.

Source: Barclays, Mercer

- Trump has promised to slash immigration, including deporting millions of illegal migrants.

Immigration surged over 2022 & 2023 but has already fallen notably this year. - Separately, Trump has expressed that he wants to be involved in monetary policy (i.e. setting interest rates), which would impact the Fed’s ability to act independently.

It’s not clear what this means in practice & Trump’s room for manoeuvre is likely to be small.

Further, the Fed Head Jerome Powell has said that he will not resign if Trump asks him to. - Trump has also said he wants a weaker $US. With tariffs having the opposite effect, it is unclear what this goal will mean in practice.

What does this mean for US growth & financial markets

For GDP growth there is a big increase in uncertainty.

Government spending & less regulation are broadly good for growth, although bigger deficits & possibly higher yields may crowd out the private sector investment, thus offsetting the boost from extra spending.

Tariffs are negative for growth & hugely disruptive for businesses.

Many believe this will hit growth not only in the US but elsewhere.

Also, we cannot be certain that all the mooted tariffs will actually be implemented or whether they will be postured & then withdrawn.

Tariffs are unlikely to cause an improvement in US competitiveness as the $US will rise to offset what on the face of it seems to be a competitive boost.

Higher tariffs & wider deficits are inflationary in the year the changes are made, but not necessarily thereafter. If

expectations remain anchored & monetary policy steers the economy well, then inflation could fall back to target.

In the near term, the Fed is likely to continue to cut interest rates & will not want to be seen as overly political. Many FOMC members will have the view that the neutral point of Fed Funds Rate is well below where it currently is, so further cuts remain a sensible course of action.

The Fed will also not want to front-run policies which may not actually happen (i.e. tariffs).

Let wrap this up

The consensus view is that there will be a return to normal.

Normal in terms of economic growth, inflation, wage growth, & monetary policy.

There are upside risks to growth from tax cuts & deregulation & downside risks from tariffs & trade wars.

There are a number of consequential actions (especially tariffs) that are very difficult to forecast regarding what impact they may have, & the response of China & other countries is largely unknown at this stage.

With this in mind & equities at all-time highs, markets are likely to stay neutral.

It is possible that China may loosen fiscal policy notably & provide a floor under the housing market.

Stronger housing & consumption along with weaker exports (to the US, but not to the rest of the world) may be a positive change for China overall.

Bond yields may face some upward pressure, but this is not certain as yields have already moved higher.

Sources: AMP, Mercer, Livewire